38 call option payoff diagram

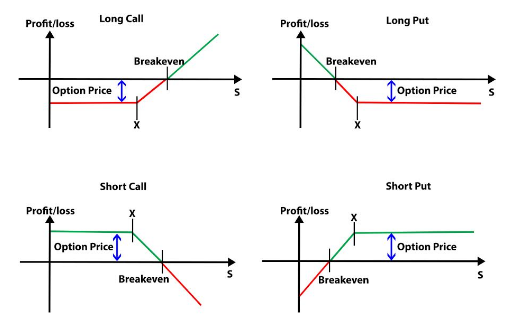

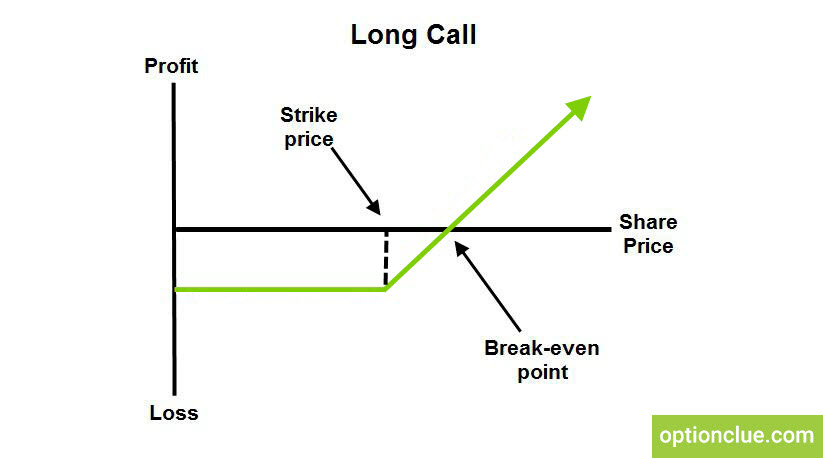

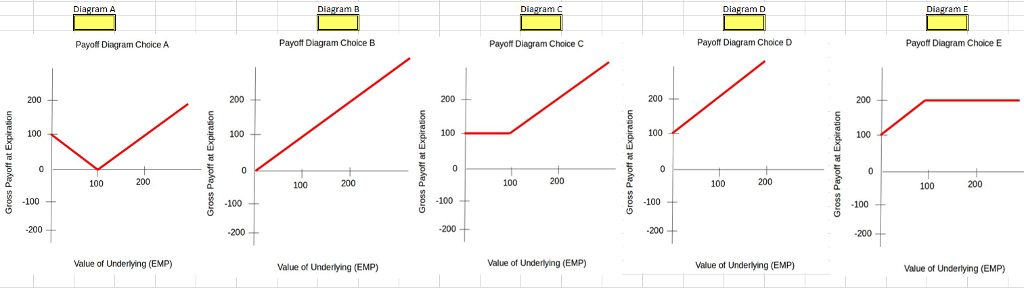

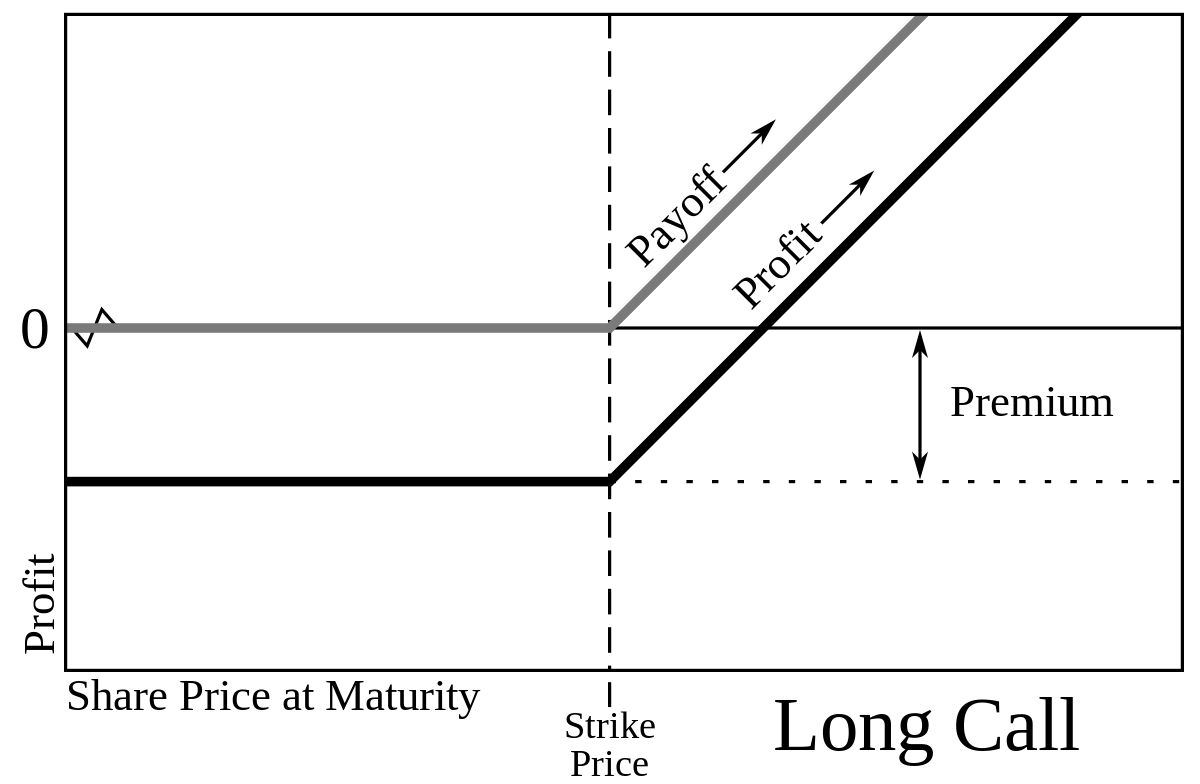

Understanding Option Payoff Charts | Selling a Call Payoff Option payoff diagrams are profit and loss charts that show the risk/reward profile of an option or combination of options. If you've never seen a payoff chart, then below we'll go through two examples of what the P&L looks like for an easy long call option (buying a call) and then a short call... Short Call Option Payoff Graph: A Beginners Guide Call Option Payoff Graph. Different Scenarios At Expiration. Understanding payoff graphs (or diagrams as they are sometimes referred) is absolutely essential for option traders. A payoff graph will show the option position's total profit or loss (Y-axis) depending on the underlying price (x-axis).

Call Option Definition | Profit = payoff - premium paid Call option payoff refers to the profit or loss that an option buyer or seller makes from a trade. Remember that there are three key variables to consider when evaluating call options: strike These variables calculate payoffs generated from call options. There are two cases of call option payoffs.

Call option payoff diagram

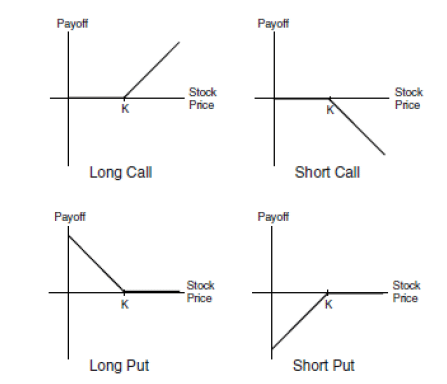

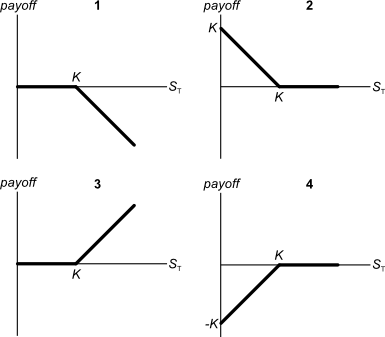

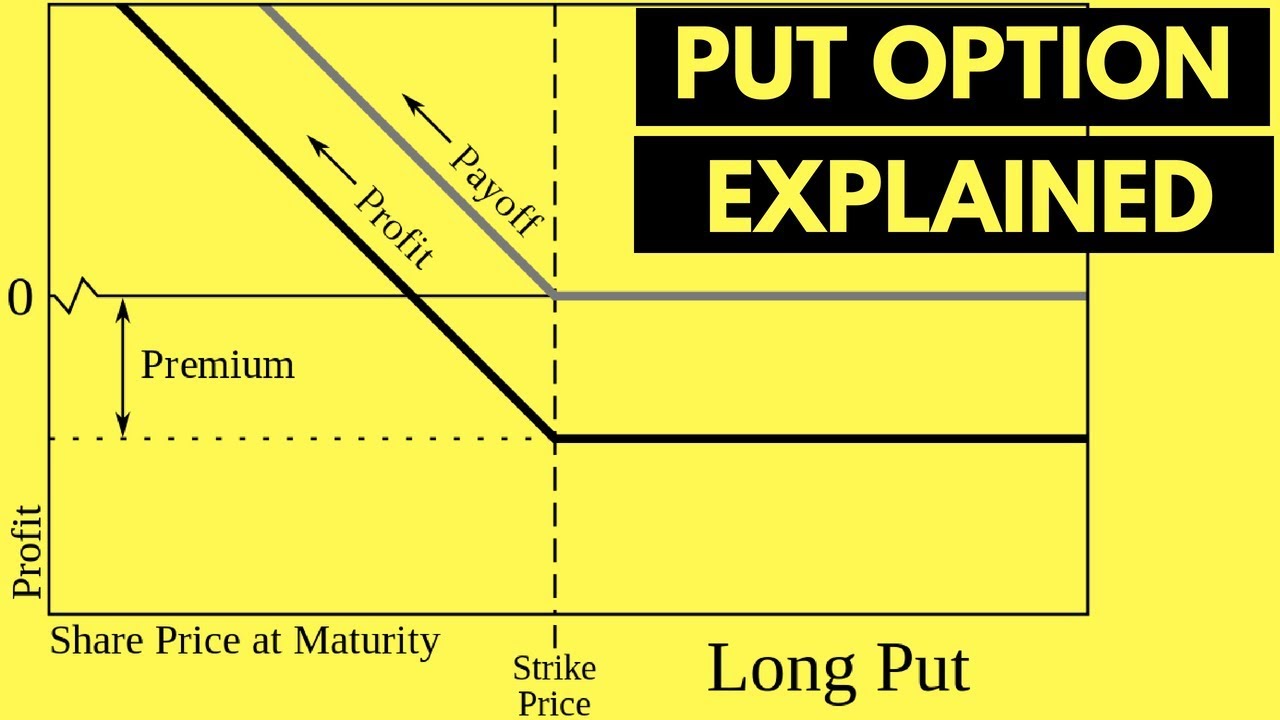

Put Option Payoff Diagram and Formula - Macroption This page explains put option profit/loss at expiration, payoff diagram, and break-even calculation. If you have seen the page explaining call option payoff, you will find the overall logic is very similar with puts; there are just a few differences which we will point out.. See also short put payoff (inverse position). Summarizing Call & Put Options - Varsity by Zerodha Please find below the pay off diagrams for the four different option variants -. Arranging the Payoff diagrams in the above fashion helps us understand We have placed the payoff of Call Option (buy) and Put Option (sell) next to each other. This is to emphasize that both these option variants make... Put Option Payoff - Finance Train The payoff diagram of a put option looks like a mirror image of the call option (along the Y axis). This diagram shows the option's payoff as the underlying price changes for the long put position. If the stock is above the strike at expiration, the put expires worthless.

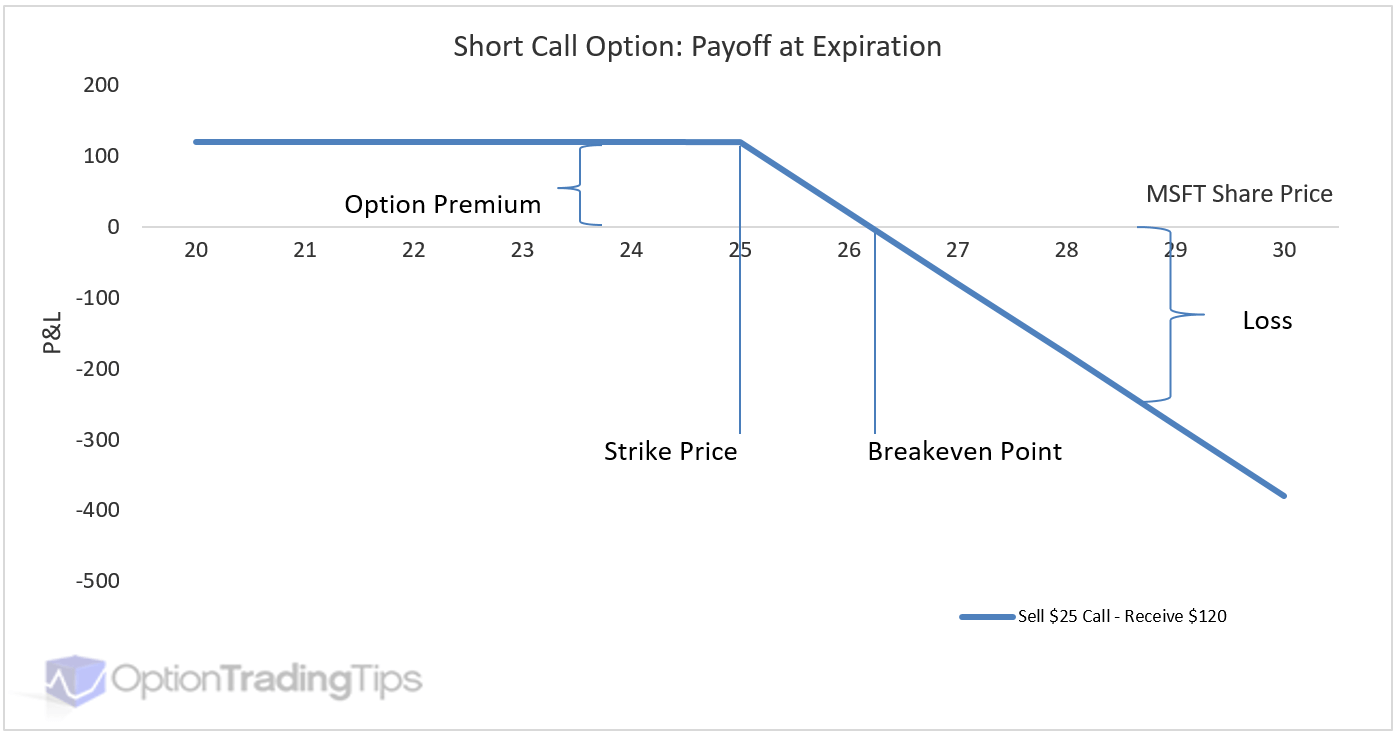

Call option payoff diagram. Writing Call Options | Payoff | Example | Strategies What is Writing Call Options. Options are one of the derivative instruments used in the world of finance in order to transfer risk from one entity to another and also can be used for hedging or arbitrage or speculation. Payoff for the seller is as below: Pay-off = min(X - ST, 0). = max(1500 - 1600, 0). Short Call Strategy Explained - Online Option Trading | 5Paisa Blog Short Call means selling of a call option where you are obliged to buy the underlying asset at a fixed price in the Following is the payoff schedule assuming different scenarios of expiry. For the ease of Payoff Diagram: Impact of Options Greeks: Delta: Short Call will have a negative Delta, which... Payoff Graphs vs Profit & Loss Diagrams - Overview, Examples Options payoffs refer to the reward or return realized from investing in or being involved in options trading. Payoff graphs are the graphical representation Profit & loss diagrams are the diagrammatic representation of an options payoff, i.e., the profit made or loss incurred on the investment made. Complete Guide to Options Strategies [Handbook] - Option Alpha Selling a call option with a $100 strike price for $2.00 has $200 of potential profit but unlimited maximum loss if the underlying stock rises significantly. ... The further above or below the payoff diagram line is from the x-axis, the greater the profit or loss at expiration. The point (or points) where the payoff diagram line crosses the x ...

Call Option Payoff Diagram Call Option Payoff Diagram. So when trading the YHOO $40 call, we paid $200 for the contract and sold it at $1,000 for a $800 profit on a $200 investment--that's a When this happens, your options are considered "out-of-the-money" and you have lost the $200 that you paid for your call option. Standard long call option payoff diagram Long Call Options Payoff Diagram. The Strategy. The long call options strategy is perhaps the most common and basic bullish options strategy. It is extremely effective in trending market environments when the market continually goes up and up and up without turning back down. Options - Payoff 1. Which one of the following statements about the value of a call option at expiration is false? a. A short position in a call option will result in a loss if the 1. Plot the payoff and profit diagrams to a straddle position with an exercise (strike) price of $130. Assume the options are priced as they are in... Payoff & profit diagrams | Positron Investments Payoff diagrams are an illustrative way to estimate at a glance the maximum positive or negative revenue from an options position/strategy, if Profit diagram of short call. Suppose we are short on the same call option. How much is the maximum profit and loss at expiration? We can see that line A...

Covered Call Payoff Diagram Covered Call Payoff Diagram. 0.00% Commissions Option Trading! Trade options FREE For 60 Days when you Open a New OptionsHouse Account. An options trader purchases 100 shares of XYZ stock trading at $50 in June and writes a JUL 55 out-of-the-money call for $2. So he pays $5000 for... Call Payoff Diagram | Daniels Trading Call Payoff Diagram. Additional Forward and Futures Contract Tutorials. American Call Options. Call Writer Payoff Diagram. Arbitrage Basics. Read an Option Profit & Loss Payoff Diagram | Option Alpha Option profit & loss or payoff diagrams help us understand where our options strategies win or lose money at expiration based on different stock price points. This is what this payoff diagram looks like for a long call option. Probably should have started with this one, but it's okay. drawing the pay-off diagram for any option strategy A Payoff diagram is a graphical representation of the potential outcomes of a strategy. Results may be depicted at any point in time, although the Here are the diagrams Short Call Strategy A short call is simply the sale of one call option. Selling options is also known as "writing" an option.

Tutorials - Introduction to Options - Put-Call... - QuantConnect.com The above payoff diagrams illustrate the cash payoff on an option at the expiration date. For a call option, the net payoff is negative if the price of the If the price of the underlying asset exceeds the strike price, the gross payoff is negative because you pay the premium for purchasing the contracts.

PDF ch_20_option.PDF | III. EXERCISE FOR THE PAYOFF DIAGRAMS. Exercise for payoff diagram IV. Assigned problems from the textbook. Therefore call option becomes less valuable the strike price increases. 3. Time to expiration → Both put and call American options become more valuable as the time to expiration increases.

Options Trading Basics Simplified - AlgoTrading101 Wiki Vice versa for option buyers. Short call option payoff diagram. Credits to optionsplaybook.com. The above is your payoff diagram when you short a straddle. This involves selling a call and put option at the same strike price.

PDF Microsoft PowerPoint - 16option | Put-Call Parity: Payoffs ƒAn American call option gives the owner the right to buy the asset at the strike price any time on or before the expiration ƒLet VT represent the value of the underlying asset on the expiration date T. ƒConsider the payoff of a European call option with strike price K. Put-Call Parity: Payoff Diagram.

PDF Introduction to options Part I. Options Basics • Options Lexicon • Options Payoffs (Payoff diagrams) • Calls and Puts as two halves of a forward contract: the Put-Call-Forward Parity • P&L from options positions (P&L diagrams) • Exchange-traded and OTC options • Option quotes • Options trading mechanics...

Call Option Profit-Loss Diagrams - Fidelity For options, profit-loss diagrams are simple tools to help you understand and analyze option strategies before investing. When buying a call, the worst case is that the share price doesn't rise to the strike price and you lose only the cost of the call, $1.50 per share in this example.

Call payoff diagram | Finance & Capital Markets | Khan Academy Call Payoff Diagram. Created by Sal Khan.Watch the next lesson...

Example 1 : Call Option Buyer Payoff Diagram of Microsoft Inc. The... Option payoff diagrams are profit and loss charts that show the risk/reward profile of an option or combination of options. If no arguments are provided, payoff diagram for a long call option will be generated with strike price as $102 and spot price $100.

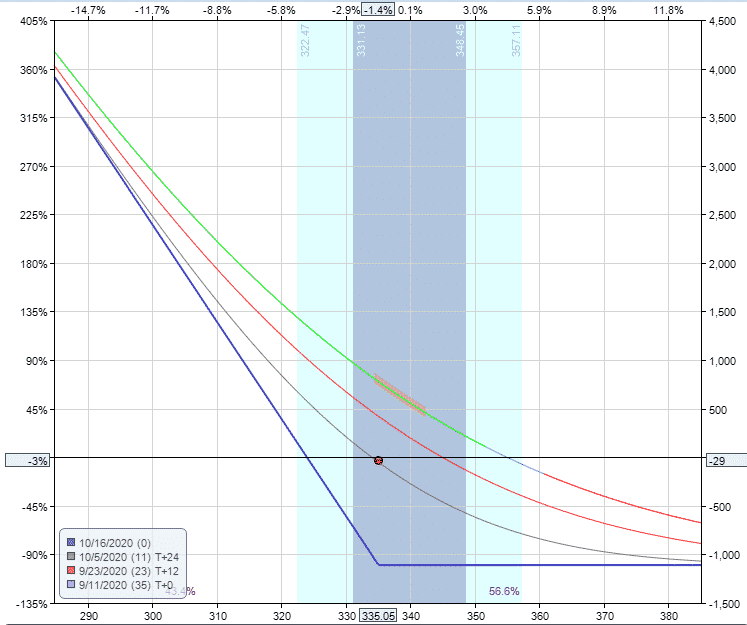

Option Strategy Payout Diagram | Learn Option Trading Option Strategy Payout Diagram Example by Market Chameleon. When you trade options it can be difficult to understand all your potential profits and losses. A payoff diagram can help you visualize your risk and rewards at different stock prices at expiration.

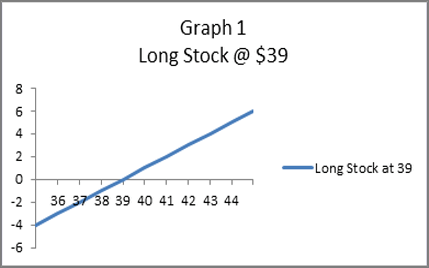

Derivatives: Pay off Diagram | Example Long Call Options According to the Payoff diagram of Long Call Options strategy, it can be seen that if the underlying asset price is lower then the strike price, the call options holders lose money which is the equivalent of the premium value, but if the underlying asset price is more than the strike price and continually...

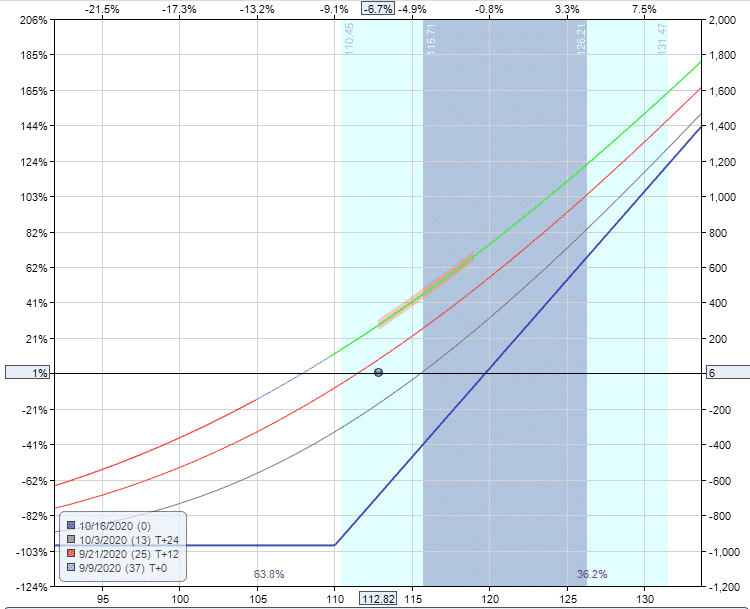

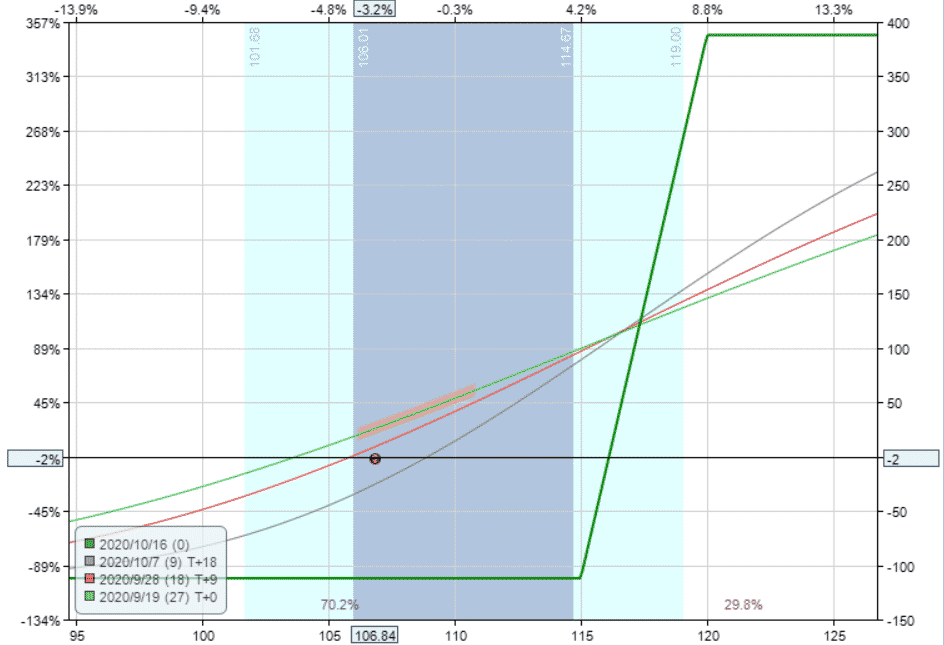

Bull Call Debit Spread - Option Alpha A bull call spread consists of buying-to-open (BTO) a call option and selling-to-open (STO) a call option at a higher strike price, with the same expiration date. This will result in paying a debit. Selling the higher call option will help reduce the overall cost to enter the trade and define the risk while limiting the profit potential.

Call Option | Definition | Payoff Formula | Example Call option is a derivative instrument, which means its value depends on the price of the underlying asset. Unlike forward contracts and future contracts, which require no payment at their inception, a call option, like any other option A put option is the exact opposite of a call option. Payoff Formula.

Call Option Payoff Diagram, Formula and Logic - Macroption The payoff diagram shows how the option's total profit or loss (Y-axis) depends on underlying price (X-axis). The key variables are A long call option's payoff chart is a straight line between zero and strike price and the payoff is a loss equal to the option's initial cost.

Introduction to Vanilla Options - Riskprep | Payoff diagrams Payoff diagrams. There are two types of options - calls and puts. Here is a simple trick that some may find useful to remember what option payoff diagrams look like.The one pay-off diagram you will need to remember is the long call.Recall that this looks as follows

Option Strategy Builder - Intraday Stock screener NSE BSE You can see the payoff diagram as soon as you add/edit legs to the options strategy. Add / Edit strategies on Option Strategy Builder. ... Bull Call Spread: Bull call spread is option strategy in which you buy At the money call and sell out of money call to reduce risk. In this spread, you have limited risk and limited profits on expiry.

Call payoff diagram (video) | Khan Academy A call payoff diagram is a way of visualizing the value of a call option at expiration based on the value of the underlying stock. Learn how to create and interpret call payoff diagrams in this video.

Put Option Payoff - Finance Train The payoff diagram of a put option looks like a mirror image of the call option (along the Y axis). This diagram shows the option's payoff as the underlying price changes for the long put position. If the stock is above the strike at expiration, the put expires worthless.

Summarizing Call & Put Options - Varsity by Zerodha Please find below the pay off diagrams for the four different option variants -. Arranging the Payoff diagrams in the above fashion helps us understand We have placed the payoff of Call Option (buy) and Put Option (sell) next to each other. This is to emphasize that both these option variants make...

Put Option Payoff Diagram and Formula - Macroption This page explains put option profit/loss at expiration, payoff diagram, and break-even calculation. If you have seen the page explaining call option payoff, you will find the overall logic is very similar with puts; there are just a few differences which we will point out.. See also short put payoff (inverse position).

![Protective Put Guide [Setup, Entry, Adjustments, Exit]](https://assets-global.website-files.com/5fba23eb8789c3c7fcfb5f31/60e7222e0b31483b2db2c010_Protective%20Put%20sizing%20adjustment.png)

:max_bytes(150000):strip_icc()/dotdash_Final_Put_Option_Jun_2020-01-ed7e626ad06e42789151abc86206a1f3.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Call_Apr_2020-02-cf56d3cf2d424ade8f6001fa23883a3c.jpg)

0 Response to "38 call option payoff diagram"

Post a Comment