38 refer to the diagram. which tax system has the most built-in stability?

Note: Appendix A to Part 36 -- Standards for Accessible Design, from the Department´s 1991 title III ADA regulation published July 26, 1991. The 1991 Standards for Accessible Design were in effect for new construction and alterations until March 14, 2012. The Department´s 2010 ADA Standards for Accessible Design were published September 15, 2010 and became effective on March 15, 2012.

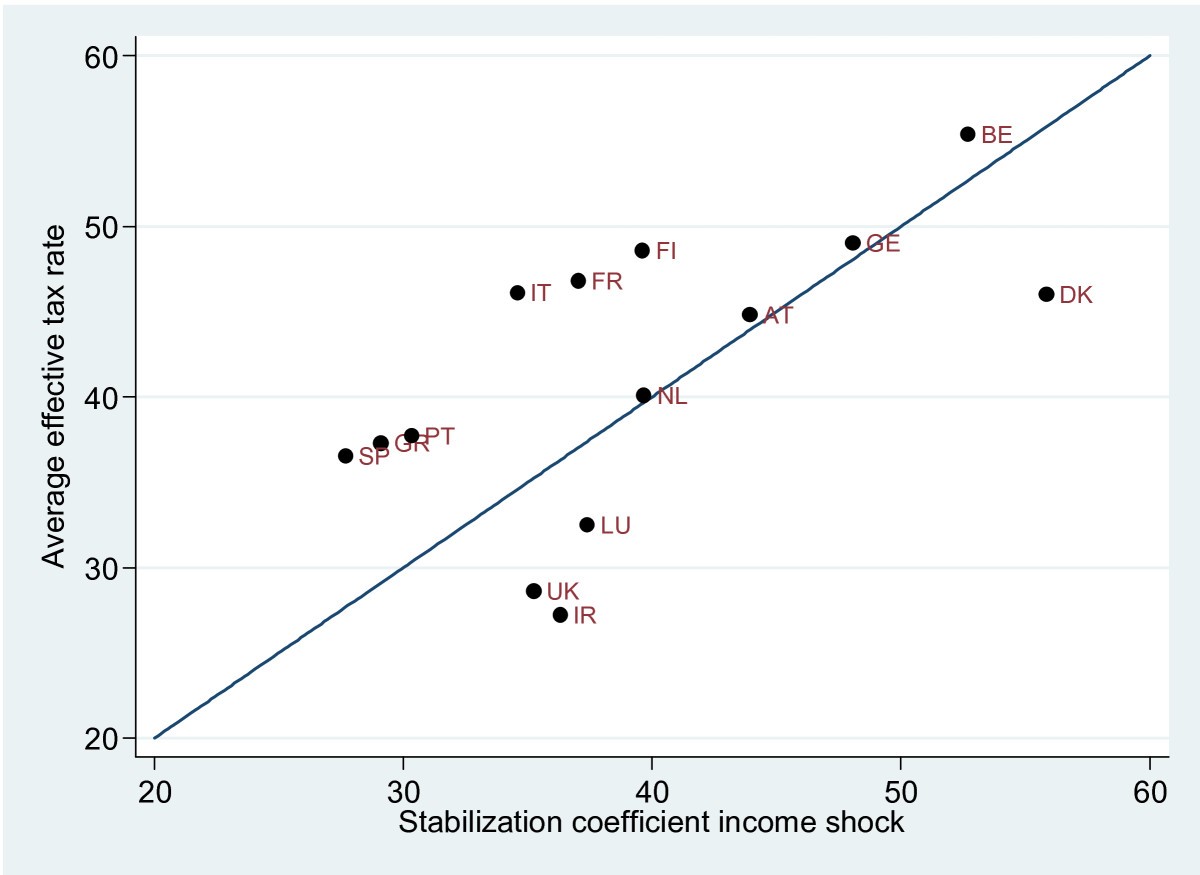

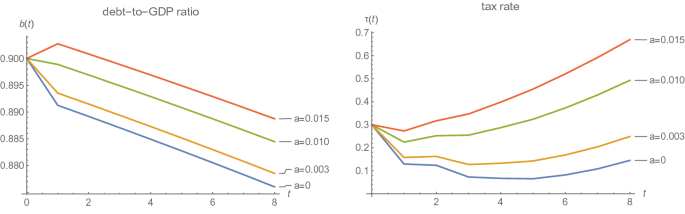

An investment tax credit is intended, of course, to stimulate additional private sector investment. A reduction in the tax rate on corporate profits would be likely to have a similar effect. Conversely, an increase in the corporate income tax rate or a reduction in an investment tax credit could be expected to reduce investment.

Refer to the above graph. Automatic stability in this economy could be enhanced by: A) Changing the tax system so that the tax line has a steeper slope B) Changing the tax system so that the tax line is shifted upward but parallel to its present position C) Changing the government expenditures line so that it has a positive slope D) Changing ...

Refer to the diagram. which tax system has the most built-in stability?

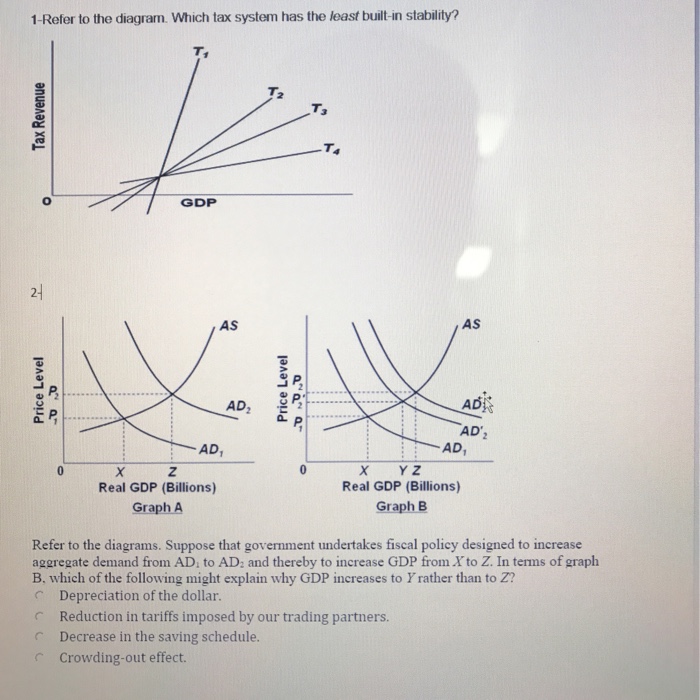

Refer to the above diagram. If the initial aggregate demand and supply curves are AD0 and AS0, the equilibrium price level and level of real domestic output will be: ... A major advantage of the built-in or automatic stabilizers is that they. ... With the expenditures programs and the tax system shown in the above diagram: answer choices . the ...

Google's free service instantly translates words, phrases, and web pages between English and over 100 other languages.

Refer to the above diagram. Which tax system will generate the largest cyclical deficits? A. T 4: B. T 3: C. T 2: D. T 1 12. R-3 F12064: Refer to the above diagram. Which tax system has the least built-in stability? A. T 4: B. T 3: C. T 2: D. T 1 13. (Last Word) Which one of the following is one of the leading economic indicators? A. index of ...

Refer to the diagram. which tax system has the most built-in stability?.

Refer to the above diagram wherein T is tax revenues and G is government expenditures.All figures are in billions.If GDP is $400: A) there will be a budget deficit. B) there will be a budget surplus. C) the budget will be balanced. D) the macroeconomy will be in equilibrium.

Refer to the diagram in which T is tax revenues and G is government expenditures. All figures are in billions. If GDP is $400: the budget will be balanced. Refer to the diagram in which T is tax revenues and G is government expenditures. All figures are in billions. The budget will entail a deficit: at any level of GDP below $400.

D) less the economy's built-in stability. Use the following to answer questions 33-36: 33. Refer to the above diagram. A contractionary fiscal policy would be most appropriate if the economy's present aggregate

Refer to the diagram, in which T is tax revenues and G is government expenditures. All figures are in billions. This diagram portrays the idea of A) progressive taxation. B) built-in stability. C) the multiplier. D) discretionary fiscal policy.

D. less is the economy's built-in stability. 29. Refer to the diagram, in which Q f is the full-employment output. A contractionary fiscal policy would be most appropriate if the economy's present aggregate demand curve were at: A. AD 0. B. AD 1. C. AD 2. D. AD 3. 30. Refer to the diagram, in which Q f is the full

C. tax revenues and government spending both vary inversely with GDP. D. government spending varies directly with GDP, but tax revenues are independent of GDP. 54. Refer to the above diagram. Which tax system has the most built-in stability? A. T 4 B. T 3 C. T 2 D. T 1 55. Refer to the above diagram. Which tax system has the least built-in ...

Next Post Next Refer to the diagram. Which tax system has the most built-in stability? Search for: Search. Recent Posts. Calculate net income given the following information: tax rate = 30%; accounts receivable = $15,000; receivable turnover = 6 times; inventory = $4,000; inventory turnover = 6.25 times; Operating expenses = ...

(Advanced analysis) Refer to the above diagram, in which C 1 is the before-tax consumption schedule. The consumption schedule represented by C 3 reflects: A) a progressive tax system. B) a proportional tax system. C) a regressive tax system. D) a higher MPC than is embodied in C 1.

Which tax system has the most built-in stability? Next Post Next Refer to the diagram. Which tax system has the least built-in stability? Search for: Search. Recent Posts. Use the graph to answer the question. - Identify the utility that accounts for over half the total bill in two months.

Refer to the diagram, where T is tax revenues and G is government expenditures. All figures are in billions of dollars. If the full-employment GDP is $400 billion while the actual GDP is $200 billion, the cyclically adjusted budget deficit is: ... Which tax system has the least built-in stability? T4. Refer to the data. The budget deficit in ...

Which tax system has the least built-in stability? A) T4 B) T3 C) T2 D) T1Answer: A 2.3) Refer to the above diagram. Which tax system will generate the largest cyclical deficits? A) T4 B) T3 C) T2 D) T1 Answer: D 3.1) If the full-employment GDP for the above economy is at L, the: A) actual budget will have a deficit.

The law of supply indicates that the price-elasticity of supply coefficient would have a negative sign. Use the method of writing each premise in symbols in order to write a conclusion that yields a valid argument. -It is either day or night. If it is daytime, then; In January 2019, workers who receive the minimum hourly wage are paid $6.10 an ...

A progressive tax system would have the most stabilizing effect of the three tax systems and the regressive tax would have the least built-in stability. A progressive tax increases at an increasing rate as incomes rise, thus having more of a dampening effect on rising incomes and expenditures than would either a proportional or regressive tax.

Refer to the diagram. Which tax system has the least built-in stability? Refer to the diagram. Which tax system has the least built-in stability? Previous Inflation can be caused either by rapid growth rate of aggregate demand or by sluggish growth of aggregate supply. Next Of the bonds found in which is the most polar?

Which tax system has the most built-in stability? A) T 4 B) T 3 C) T 2 D) T 1. Page 3 6. The "cyclically adjusted budget" refers to: ... Refer to the above diagram where T is tax revenues and G is government expenditures. All figures are in billions of dollars. If the full-employment GDP is $400 billion while

Transcribed Image Textfrom this Question. Tax Revenue GDP Refer to the diagram. Which tax system has the least built-in stability? Select one: о а. Tз ob. Та.

Which tax system has the most built-in stability? T1. The standardized budget tells us: ... Refer to the above diagram. Assume that G and T1 are the relevant curves and that the economy is currently at B, which is its full-employment GDP. This economy has a: standardized budget surplus and an actual budget surplus.

Refer to the above diagram. Which tax system has the most built-in stability? refer to quiz A. T4 B. T3 C. T2 D. T1. D. T1. 23. Refer to the above diagram. Which tax system has the least built-in stability? refer to quiz A. T4 B. T3 C. T2 D. T1. A. T4. 24. The degree of built-in stability in the above economy could be increased by:

Refer to the above diagram. Which tax system has the most built-in stability? refer to quiz A. T4 B. T3 C. T2 D. T1. A. T4. 23. Refer to the above diagram. Which tax system has the least built-in stability? refer to quiz A. T4 B. T3 C. T2 D. T1. C. changing the tax system so that the tax line has a greater slope. 24. The degree of built-in ...

70. (Advanced analysis) Refer to the diagram, in which C 1 is the before-tax consumption schedule. Other things being equal, the economy would enjoy the greatest built- in stability with consumption schedule A. C 1 B. C 2 C. C 3 D. C 4 . . . . 71. Gross Domestic Product (GDP) Consumption (C) $0 $40 100 120 200 200 300 280 400 360 The ...

0 Response to "38 refer to the diagram. which tax system has the most built-in stability?"

Post a Comment