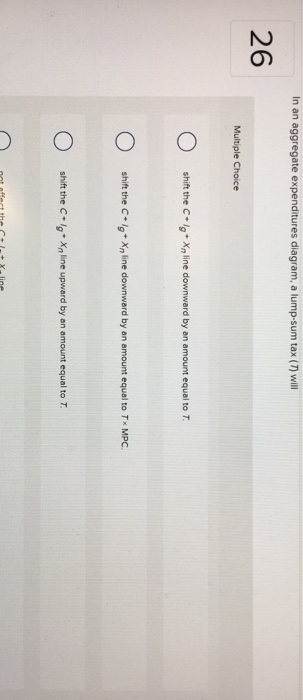

36 in an aggregate expenditures diagram, a lump-sum tax (t) will

Introduction to Macroeconomics - Chapter 22 Lump sum taxes are independent of the level of income and this makes the analysis very similar to that for autonomous spending. If we had considered income taxes, which are a function of income, then the model would become more complicated because changes in income tax rates would not only shift... - Best Custom Writing Services Mar 08, 2017 · We always make sure that writers follow all your instructions precisely. You can choose your academic level: high school, college/university, master's or pHD, and we will assign you a writer who can satisfactorily meet your professor's expectations.

Lump Sum Contracts: Advantages, Disadvantages & When... | NetSuite So, what does lump sum mean in a contract? Lump sum contracts are standard in construction projects, but they aren't suitable for every situation. These contracts work best for projects with finalized plans, clearly defined scopes and schedules and proper documentation of all assessments and other...

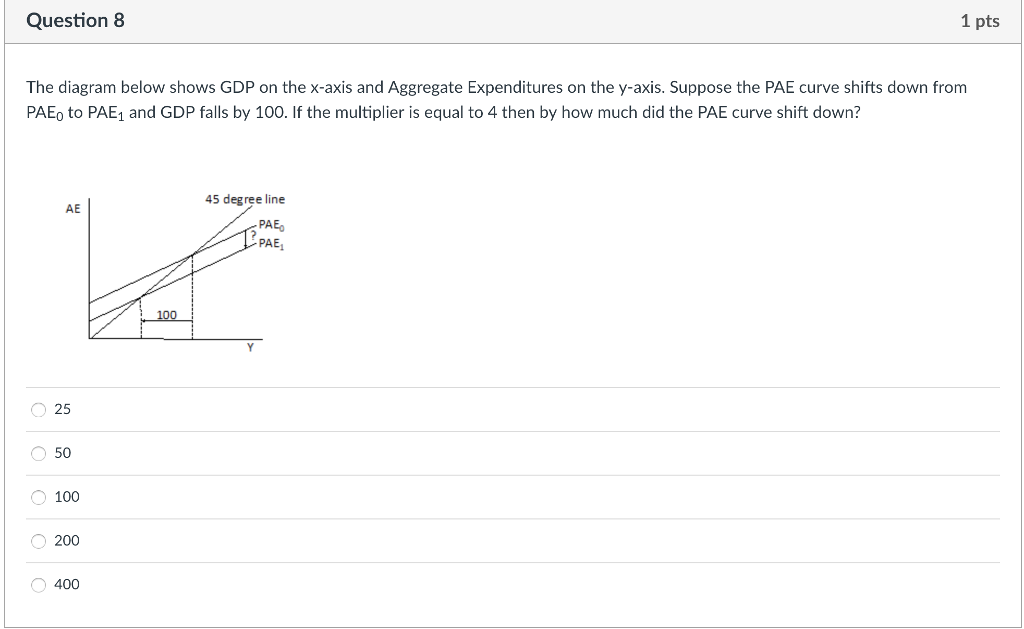

In an aggregate expenditures diagram, a lump-sum tax (t) will

fountainessays.comFountain Essays - Your grades could look better! Feb 28, 2018 · Ensure you request for assistant if you can’t find the section. When you are done the system will automatically calculate for you the amount you are expected to pay for your order depending on the details you give such as subject area, number of pages, urgency, and academic level. Lump-Sum Taxation - an overview | ScienceDirect Topics Lump-Sum Taxation. In particular, a head tax per house is required in order for property value maximization to lead to a first-best allocation. Suppose the government needs to raise revenue and needs to do this in a distortionary manner; the most common example would involve labor taxation... How to Save Millions with Lump Sum Taxation in Switzerland Save Millions in Taxes like Formula 1 Drivers with the Swiss Lump Sum Taxation in Switzerland. It is your yearly living expenses that will determine your Lump Sum Taxation and your final tax bill. Consequently Swiss Lump Sum Taxation is also known as Expenditure-based Taxation.

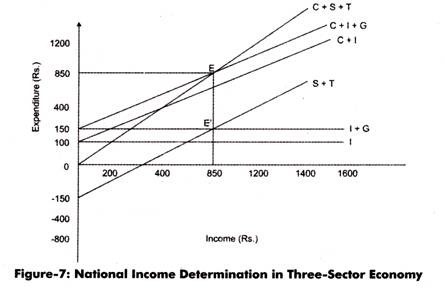

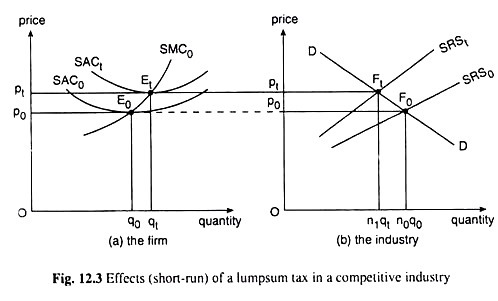

In an aggregate expenditures diagram, a lump-sum tax (t) will. Effects of Lump-Sum Taxes in a Competitive Industry To obtain the effects of a lump-sum tax, let us now suppose that the government imposes such a Since the imposition of the lump-sum tax keeps the firm's total variable cost (TVC) function unaffected, it keeps the firm's MC function also Excess Capacity in Monopolistic Competition (With Diagram). finalexamsolutions.wordpress.comExams and Quiz Solutions - finalexamsolutions Describe accounting for uncertain tax positions under FIN No. 48, now FASB ASC 740-10-25. Discuss the rationale behind the calculation of a company’s earnings conservatism ratio. Chapter 13 Under the capital method of accounting for leases the excess of aggregate rentals over the cost of leased property should be recognized as revenue of the ... First Fiscal Model and Equilibrium Level of... - Businesstopia Government follows a lump sum tax policy which means individuals and firms should pay a fixed amount of tax regardless of their level of As stated earlier, aggregate expenditure (AE) in the three economic model is the sum of household's consumption expenditure (C), business investment... (PDF) Aspirations and Optimal Taxation: Lump-Sum and Proportional... a lump-sum tax depends on each of the model parameters. The vertical axis shows the. gain in social welfare when using a proportional labor (positive values thus correspond. For a sufficiently high level of tax. revenues raised, a lump-sum tax is then again superior to a proportional tax.

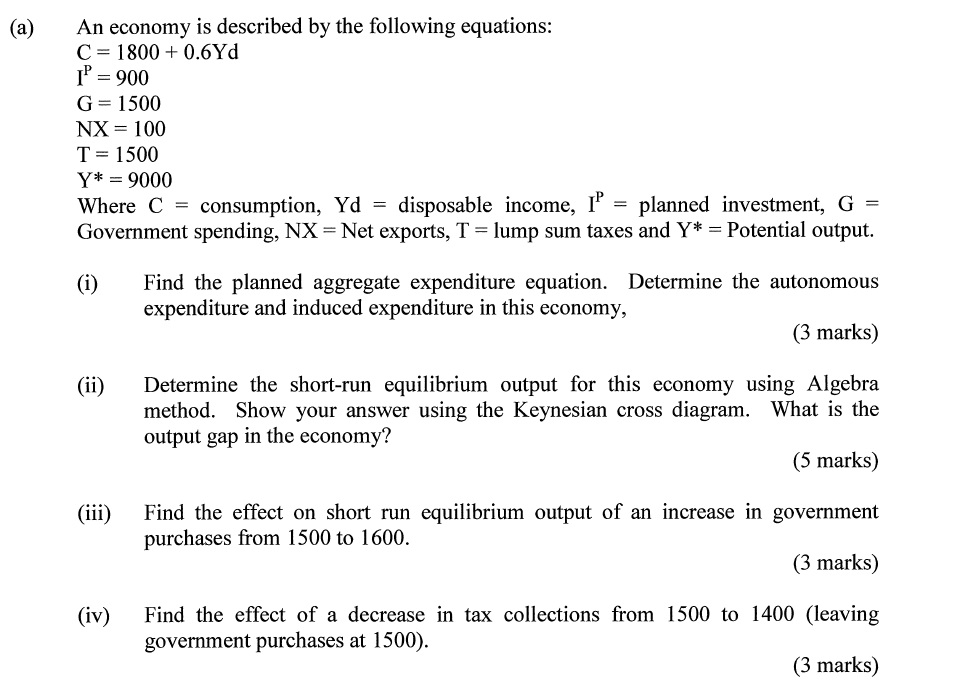

How to calculate aggregate expenditure? | semaths.com Aggregate expenditure is the current value of all the finished goods and services in the economy. The equation for aggregate expenditure is: AE = C + I + G + NX. The aggregate expenditure equals the sum of the household consumption (C), investments (I), government spending (G), and net exports... Solved In an aggregate expenditures diagram, a lump-sum tax Transcribed image text: In an aggregate expenditures diagram, a lump-sum tax (7) will 26 Multiple Choice shift the C+19+ Xnline downward by an amount equal to T. O shift the C+ lg* Xnline downward by an amount equal to TX MPC shift the C+/Xline upward by an amount equal to T. Chapter 23: expenditure multiplier | The Lump sum Tax multiplier Aggregate Expenditure function (AE): n will have a positive intercept (see graph pg. n if the government has a lump sum tax (so the tax rate, t = 0),then a $1 increase in taxes would reduce This reduction in expenditures is then subject to the multiplier. The end result is that when taxes (T)... Chapter 10 - Aggregate Expenditures: The Multiplier, Net Exports... Net exports (exports minus imports) affect aggregate expenditures in an open economy. Imports (M) reduce the sum of consumption and investment expenditures by the amount expended on imported goods, so this figure must be subtracted so as not to overstate aggregate expenditures on...

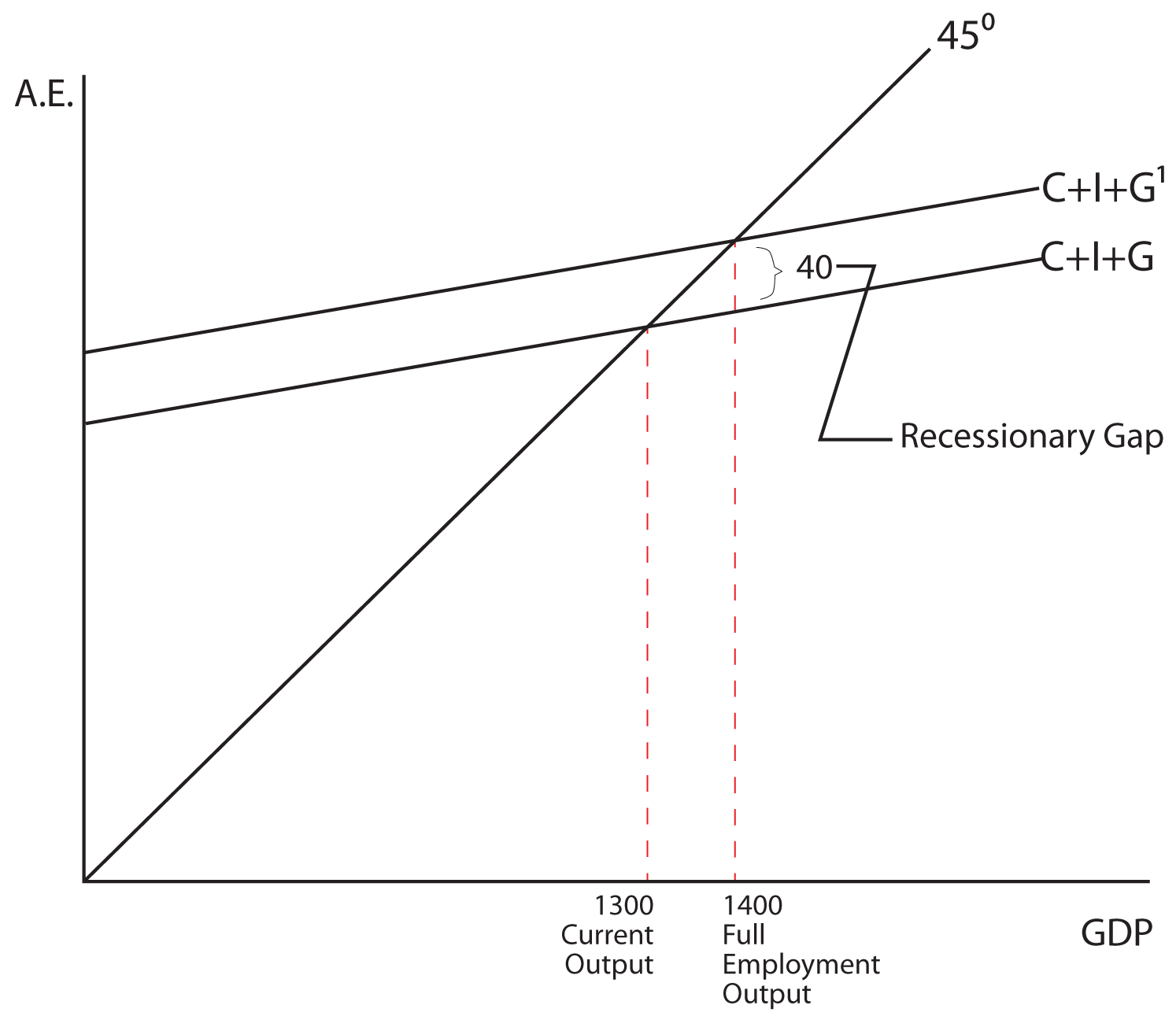

(1) A reduction in the lump sum tax (2) A rise in the marginal... ...a lump sum tax system, how much tax decrease would have the same effect on the equilibrium 99 #1 The diagram below shows the aggregate expenditure in a closed economy without taxes. C The sum of government spending and investment spending is greater than the sum of taxation and... Lump-Sum Payment Definition A lump-sum payment is not the best choice for every beneficiary; for some, it may make more sense for the funds to be annuitized as periodic payments. Based on interest rates, tax situation, and penalties, an annuity may end up having a higher net present value (NPV) than the lump sum. › 9770363 › Macroeconomics_ANSWER(PDF) Macroeconomics (ANSWER KEY TO CHAPTER ... - Academia.edu Academia.edu is a platform for academics to share research papers. Solutions Manual Ch28 - ECN204 - Introductory... - StuDocu Depict graphically the aggregate expenditures model for a private closed economy. Now show a decrease in the aggregate expenditures a. Graph this consumption schedule and determine the MPC. b. Assume now that a lump-sum tax is imposed such that the government collects $10 billion in...

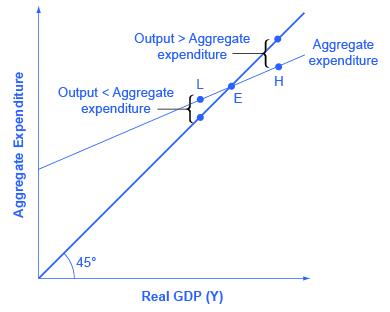

PDF Lesson 7 - ECO 151- Master.nb | Aggregate Expenditure Model In the aggregate expenditure model we assume that investment does not change as real GDP changes. There are factors that will cause the investment to shift up and down. What would naturally happen in an economy if spending were greater than production and inventories were falling?

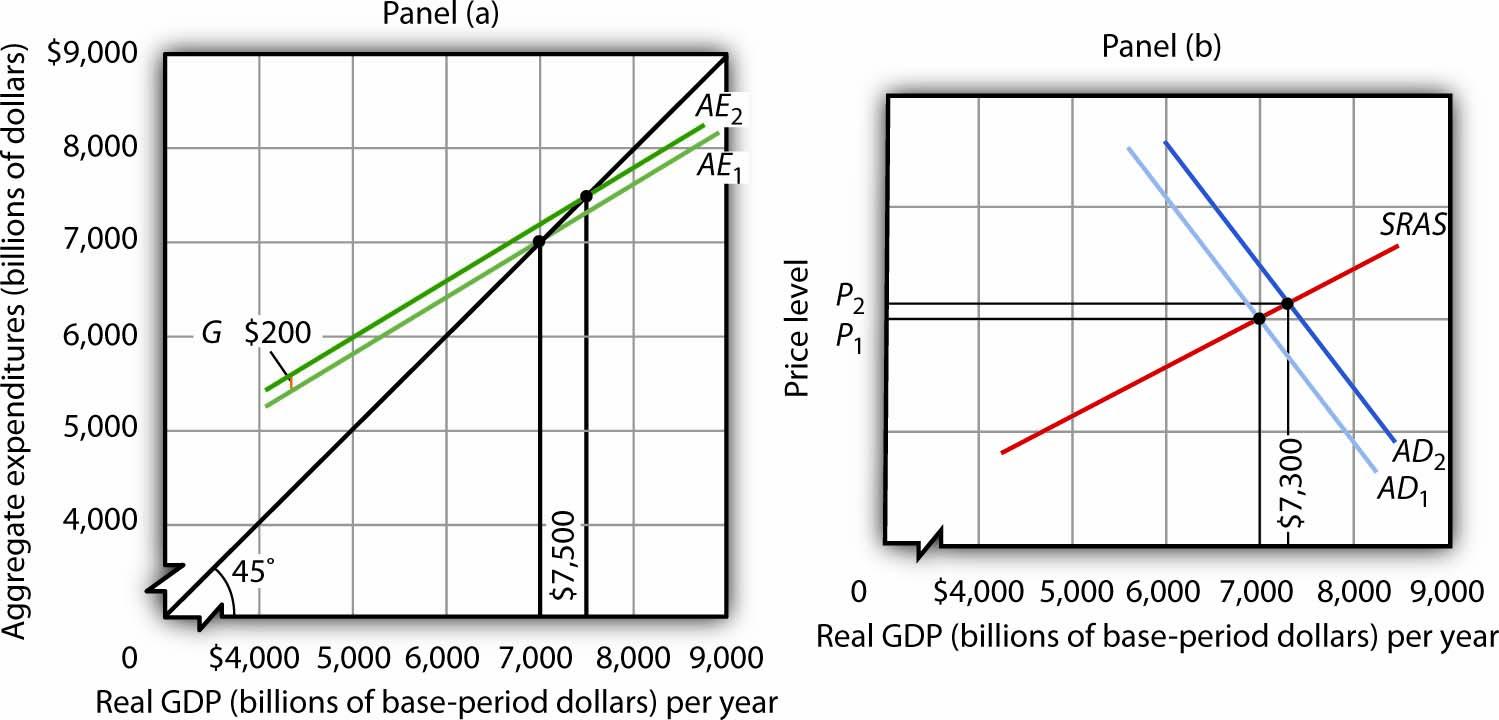

13.3 Aggregate Expenditures and Aggregate Demand - Principles of... An aggregate expenditures curve assumes a fixed price level. In the aggregate expenditures model, a change in autonomous aggregate expenditures changes equilibrium real GDP by the multiplier times the Refundable lump-sum tax rebate. 1.22. Temporary tax cuts. Payroll tax holiday.

Econ Chapter 11 Flashcards | Quizlet

The Aggregate Expenditures Model PowerPoint Presentation 9. The Aggregate Expenditures Model. Keynesian Theory. Chapter Objectives. Aggregate Expenditures - . the four expenditure components of national income accounting were developed around the. Income-Expenditure Equilibrium The Keynesian cross is a diagram that identifies...

Lump-sum tax - Wikipedia A lump-sum tax is a special way of taxation, based on a fixed amount, rather than on the real circumstance of the taxed entity. In this, the entity cannot do anything to change their liability. In contrast with a per unit tax, lump-sum tax does not increase in size as the output increases.

A lump sum tax means that A the tax only applies to... | Course Hero 170. In an aggregate expenditures diagram, a lump-sum tax (T) will: T . T . MPC. Chapter 28 - The Aggregate Expenditures Model 173. If a lump-sum tax of $40 billion is imposed and the MPC is 0.6, the saving schedule will shift: A. downward by $24 billion.B. upward by $24 billion.C. downward...

Use the following to answer question 1 - Humble ISD In an aggregate expenditures diagram, a lump-sum tax (T) will: B) shift the C + I, + X, line upward by an amount equal to T. . C) not affect the C + I, + X 14. A $10 billion decrease in taxes will increase the equilibrium GDP by more than would a $10 billion. Use the following to answer question 15

Application of Indifference Curves: Lump Sum vs The second tax is a lump sum tax. That is, a tax of some fixed amount that does not correspond with the number of units Marge decides to buy of either good. The new lump sum tax would reduce her Marge's income by $20, but, unlike the per unit tax, will leave the price of beer unchanged.

Ch 11 economics - Subjecto.com Which aggregate expenditure schedule AE in the diagram for a private closed economy implies the largest MPC, assuming investment is the same at each level of income? Investment and saving are, respectively. injections and leakage. In an aggregate expenditures diagram, a lump-sum tax (T) will.

PDF Chapter 4 | 6. Refer to the above diagram. The vertical intercept If a lump-sum tax of $20 is imposed, the consumption schedule will become Given the levels of investment and taxes already specified, the addition of governmental expenditures of $10 at each level of GDP will result in an equilibrium GDP of Aggregate expenditures closed economy.

Aggregate Expenditure Aggregate Expenditure is a measure of national income. It is a way to measure the total GDP or Gross Domestic Product (A measure of the level of economic activity). Gov't spending and equilibrium GDP c Aggregate expenditures Gov't spending increase b a ● ● d e Real GDP Point 'a' -- In a private...

How to Calculate Taxes on a Lump Sum | Sapling You'll calculate the taxes on your lump sum distribution using IRS Form 4972 and the information on the Form 1099-R that will be sent to you by the financial institution handling If you instead treat the distribution as if it were paid over 10 years, the smaller amounts may keep you in a lower tax bracket.

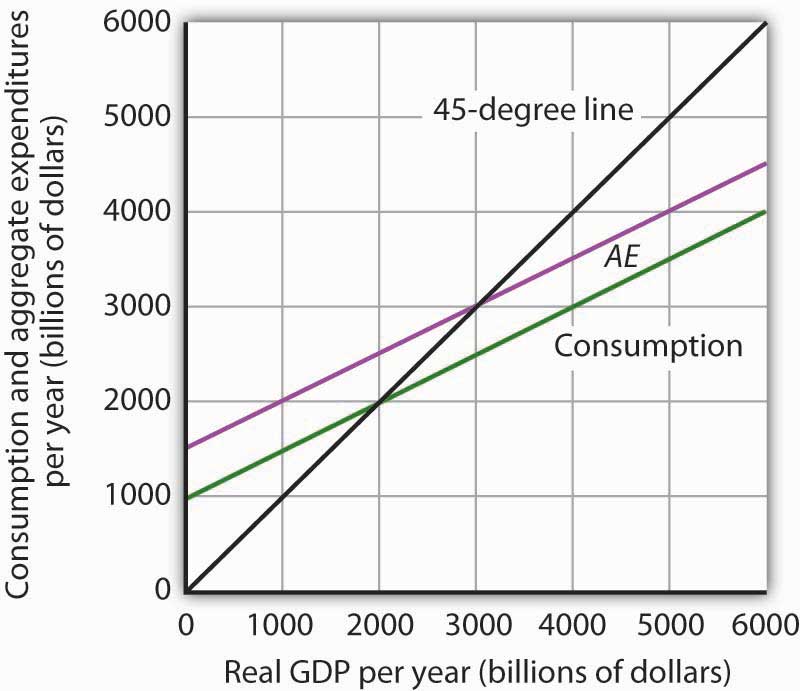

Lecture Notes -- The Income-Expenditure Model Aggregate Expenditures in the Income-Expenditure Diagram. Aggregate Expenditures is the aggregate amount that consumers, investors, government, and foreigners wish to spend on the purchase of Aggregate Expenditures is simply the sum of these elements, or AE = C + I + G + NX.

www-personal.umd.umich.edu › ~mtwomey › econhelpUM-D Econ 301 Exams - University of Michigan 5. Supply siders don't like taxes. One tax which we are already. in a position to analyze theoretically is the personal income. tax. Explain, illustrating with graphs, the supply side analysis of. the impact of increasing the personal income tax, on: employment, real wages, prices, and output. The median on this exam was 55; the high was 95

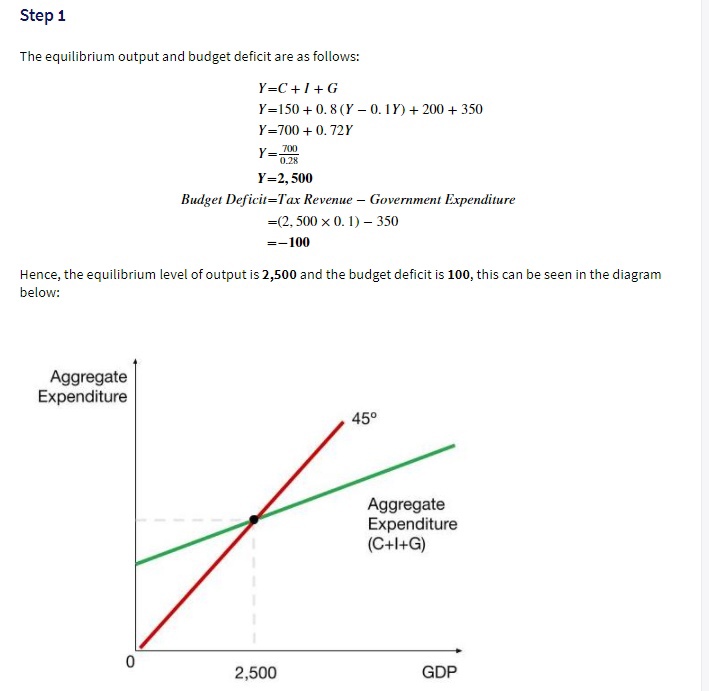

› Homework for Chapter 10_answersHomework for Chapter 10 answers - University College London 10-3 Graphically depict the aggregate expenditures model for a private closed economy. Next, show a decrease in the aggregate expenditures schedule and explain why the decrease in real GDP in your diagram is greater than the initial decline in aggregate expenditures. What would be the ratio of a decline in real GDP to the initial drop in aggregate

Introducing Aggregate Expenditure | Boundless Economics The aggregate expenditure is one of the methods that is used to calculate the total sum of all the economic activities in an economy, also known as the gross domestic product ( GDP ). It is the sum of all the expenditures undertaken in the economy by the factors during a specific time period.

In an aggregate expenditures diagram, a lump-sum tax... | Quizlet Quizlet is a lightning-fast way to learn vocabulary.

The Aggregate Expenditures Model - ppt video online download Positive net exports increase aggregate expenditures beyond what they would be in a closed economy and thus have an expansionary effect. 29 ADDING THE PUBLIC SECTOR Lump-Sum Tax and Equilibrium GDP $15 Billion Decrease in Consumption from a $20 Billion Increase in Taxes C...

Essays - Best Custom Writing Services Get 24⁄7 customer support help when you place a homework help service order with us. We will guide you on how to place your essay help, proofreading and editing your draft – fixing the grammar, spelling, or formatting of your paper easily and cheaply.

How to Save Millions with Lump Sum Taxation in Switzerland Save Millions in Taxes like Formula 1 Drivers with the Swiss Lump Sum Taxation in Switzerland. It is your yearly living expenses that will determine your Lump Sum Taxation and your final tax bill. Consequently Swiss Lump Sum Taxation is also known as Expenditure-based Taxation.

Lump-Sum Taxation - an overview | ScienceDirect Topics Lump-Sum Taxation. In particular, a head tax per house is required in order for property value maximization to lead to a first-best allocation. Suppose the government needs to raise revenue and needs to do this in a distortionary manner; the most common example would involve labor taxation...

fountainessays.comFountain Essays - Your grades could look better! Feb 28, 2018 · Ensure you request for assistant if you can’t find the section. When you are done the system will automatically calculate for you the amount you are expected to pay for your order depending on the details you give such as subject area, number of pages, urgency, and academic level.

![[大學Micro] Labour Market (Indifference curve) - Lump sum Tax](https://i.ytimg.com/vi/kP0T4bPVZic/maxresdefault.jpg)

0 Response to "36 in an aggregate expenditures diagram, a lump-sum tax (t) will"

Post a Comment