35 private equity fund structure diagram

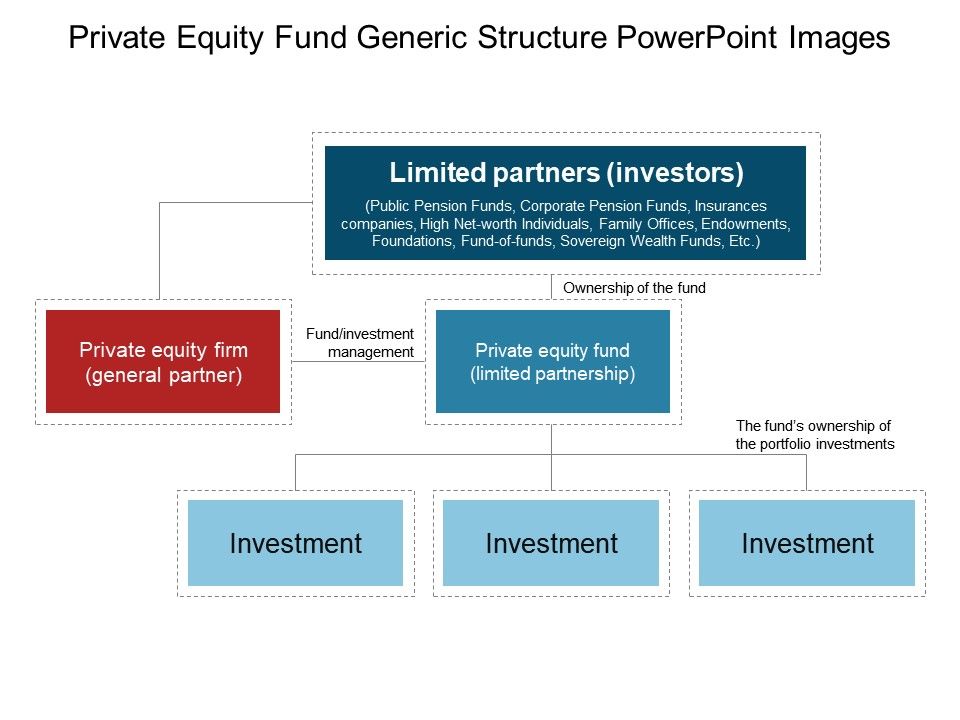

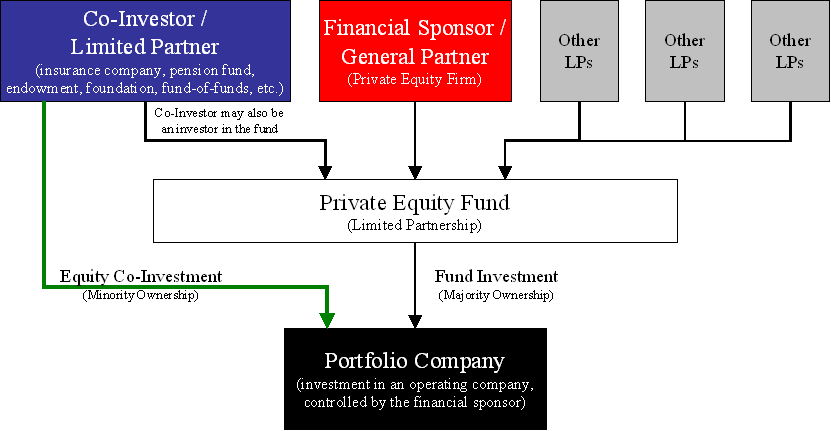

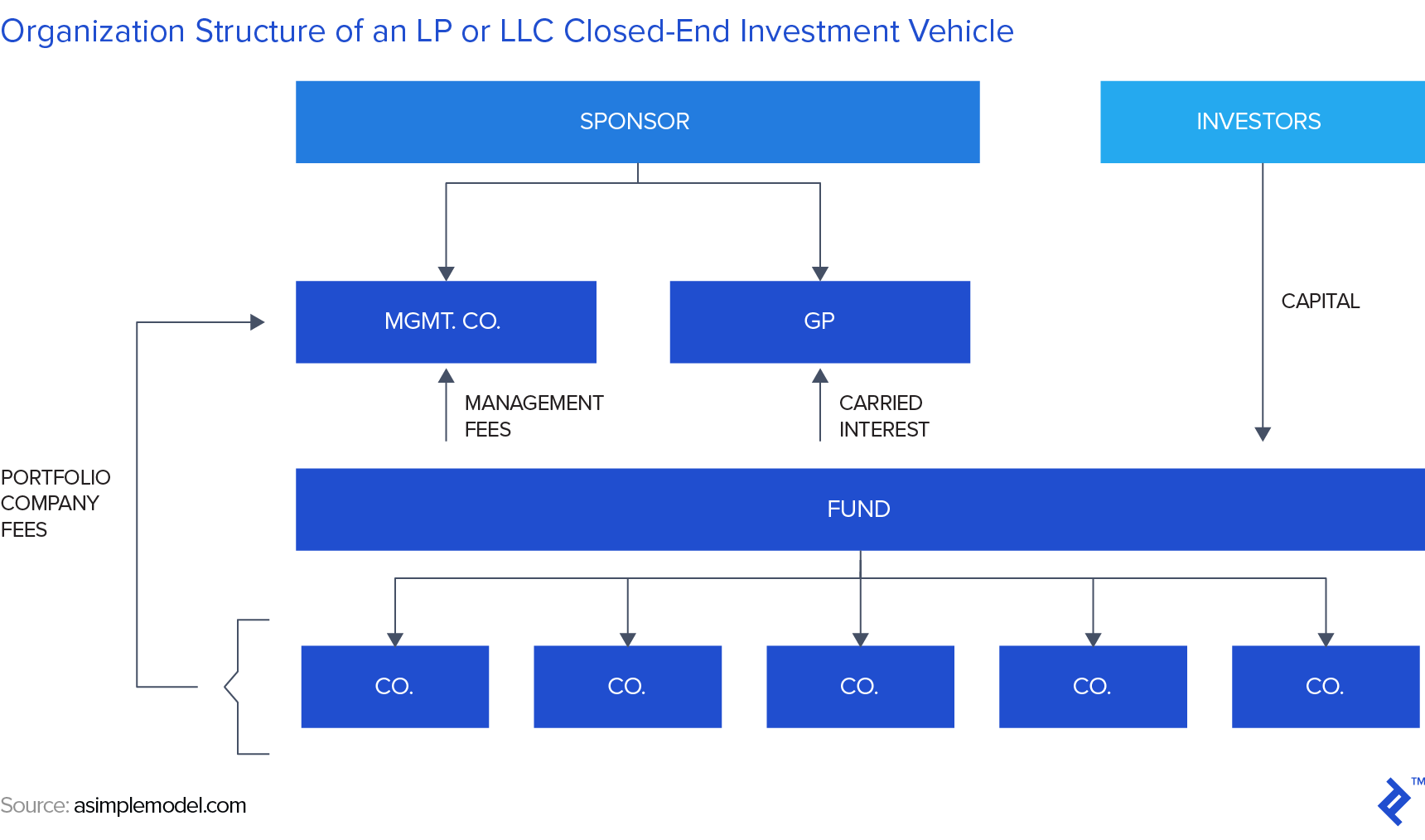

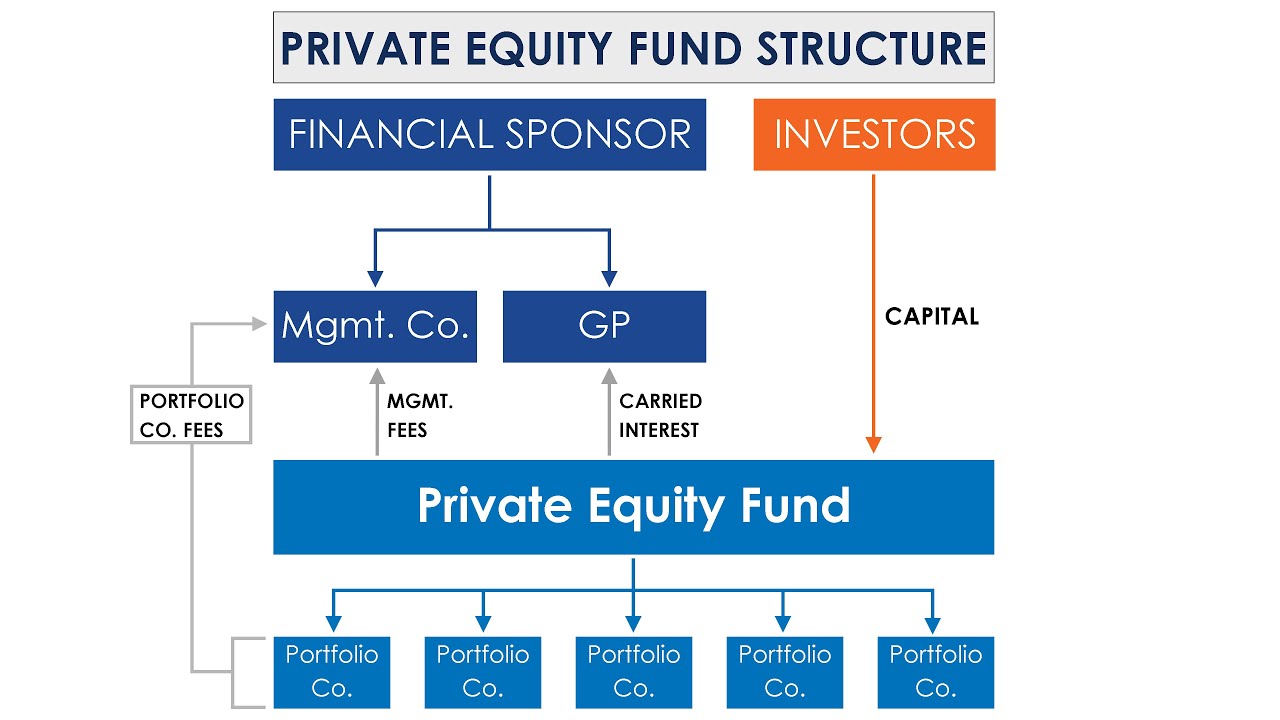

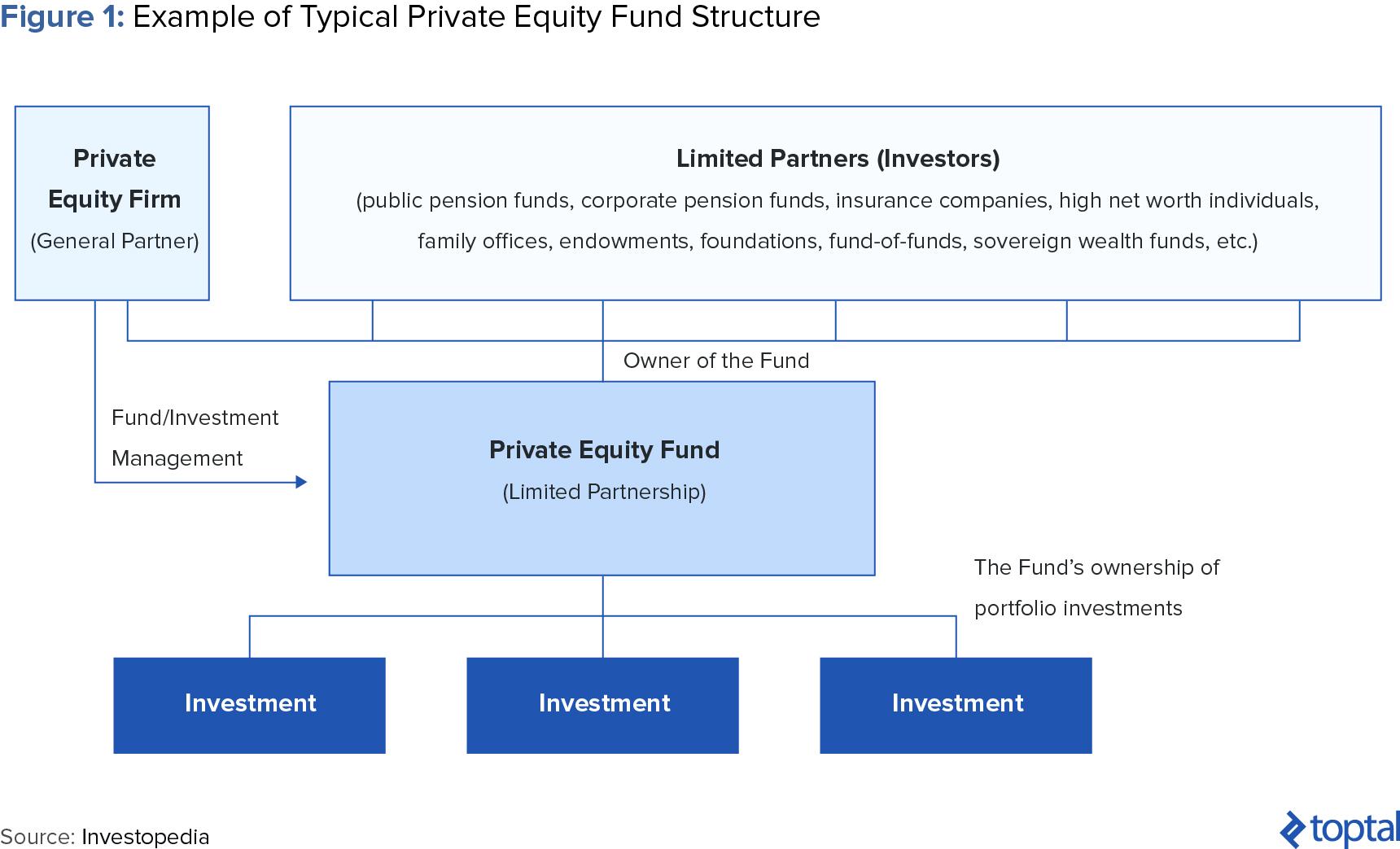

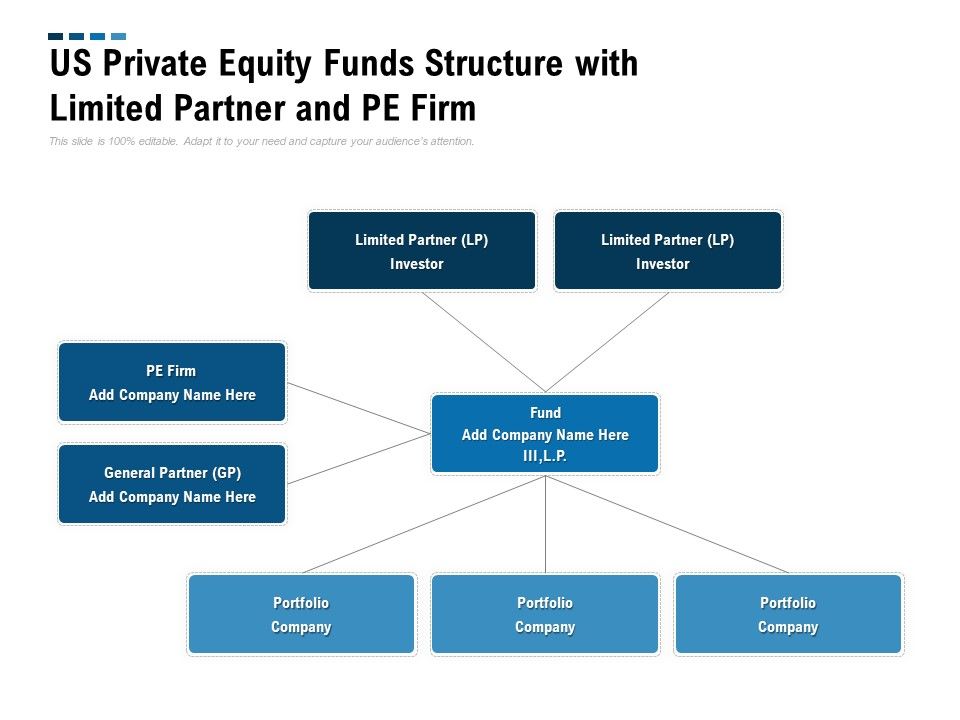

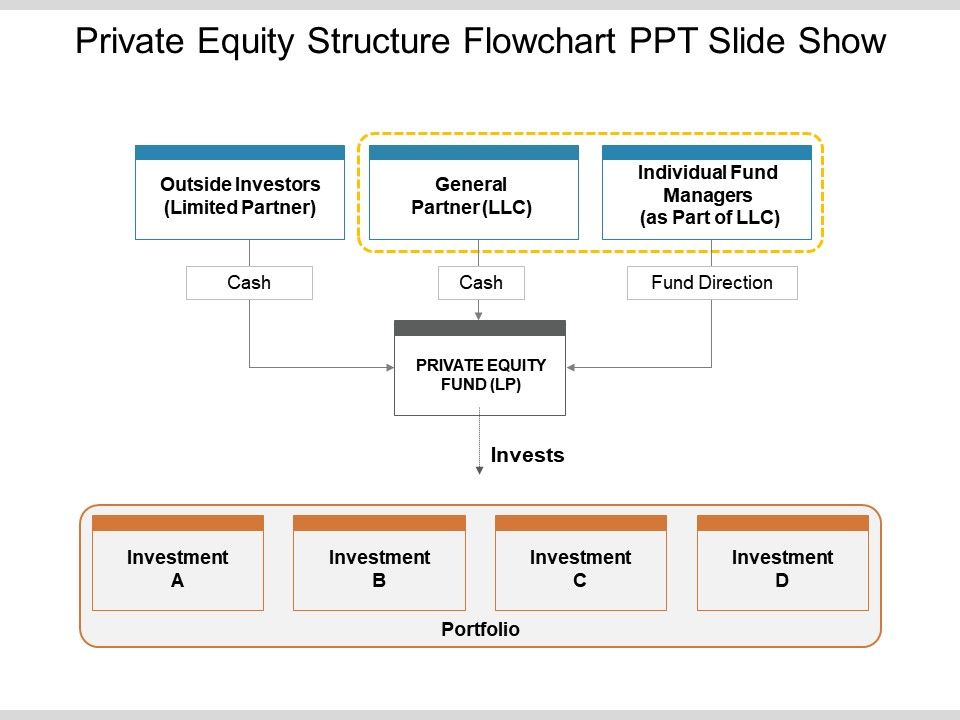

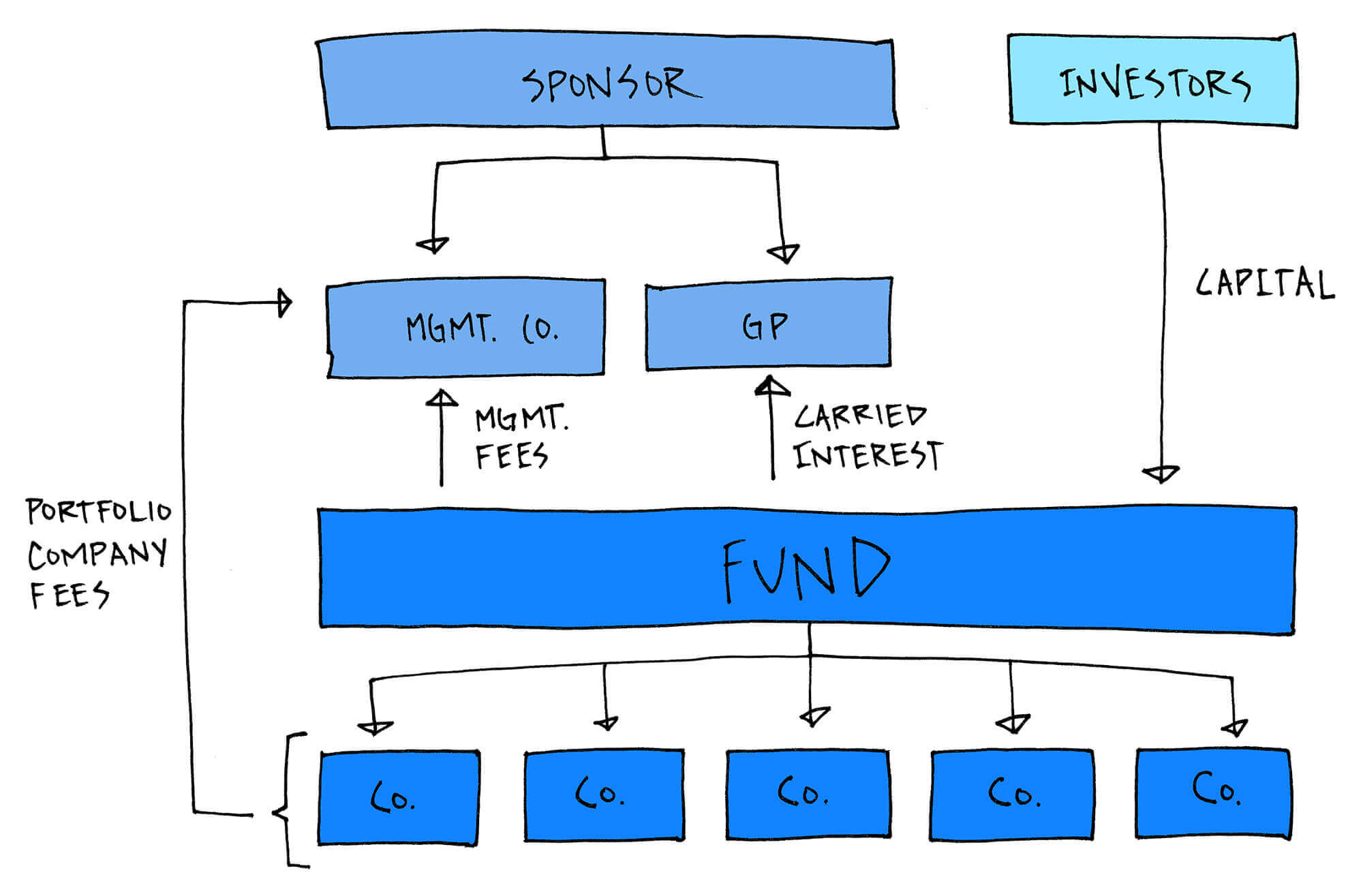

Most venture and private equity funds use a limited partnership as their legal structure (Figure 2), which involves two main types of actors: (1) a general partner (GP) and (2) limited partners (LPs).

regulatory structure under which mutual funds are regulated. Hedge funds and private equity funds are typically structured to be exempt from the Investment Company Act under one of two exemptions: Section 3(c)(1) or Section 3(c)(7). "Because of the high barrier to investment, the 3(c)(7) is typically used only by established funds

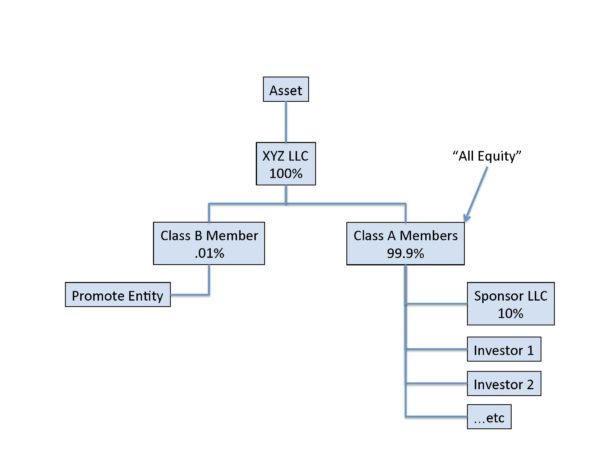

Private Equity Fund Structure Peter Lynch Private equity funds are closed-end investment vehicles, which means that there is a limited window to raise funds and once this window has expired no further funds can be raised. These funds are generally formed as either a Limited Partnership ("LP") or Limited Liability Company ("LLC").

Private equity fund structure diagram

Private equity is invested in exchange for a stake in your company and, as shareholders, the investors' returns are dependent on the growth and profitability of your business. Private equity in the UK originated in the late 18th century, when entrepreneurs found wealthy individuals to back their projects on an ad hoc basis.

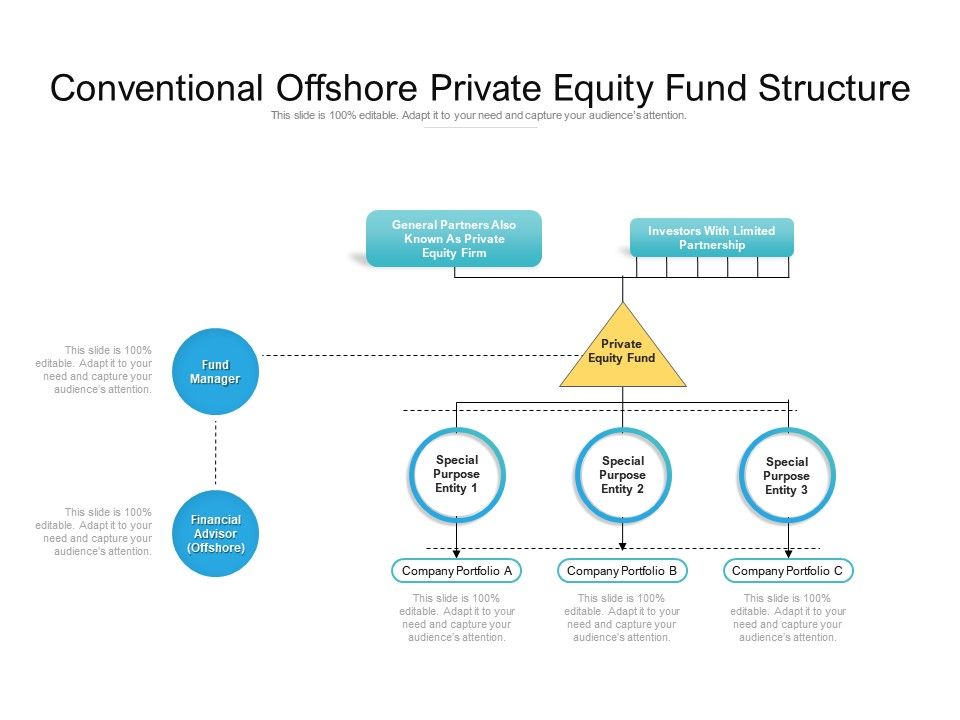

Where a private equity fund invests in a flow-through portfolio company engaged in a U.S. business (i.e., a portfolio company organized as a partnership or LLC), certain tax-sensitive fund LPs — virtually all non-U.S. LPs and many U.S. tax-exempt LPs — typically elect to hold their share of such fund investment through a "blocker corpora -

Private equity fund structure diagram. In private equity funds and joint ventures operating agreements between equity partners employ cash distribution rules that. Understanding private equity fund structure. All institutional partners of the fund will agree on set terms laid out in a limited partnership agreement lpa.

Private equity fund structure diagram.

Private Equity Fund Structure Peter Lynch Private equity funds are closed-end investment vehicles, which means that there is a limited window to raise funds and once this window has expired no further funds can be raised. These funds are generally formed as either a Limited Partnership ("LP") or Limited Liability Company ("LLC").

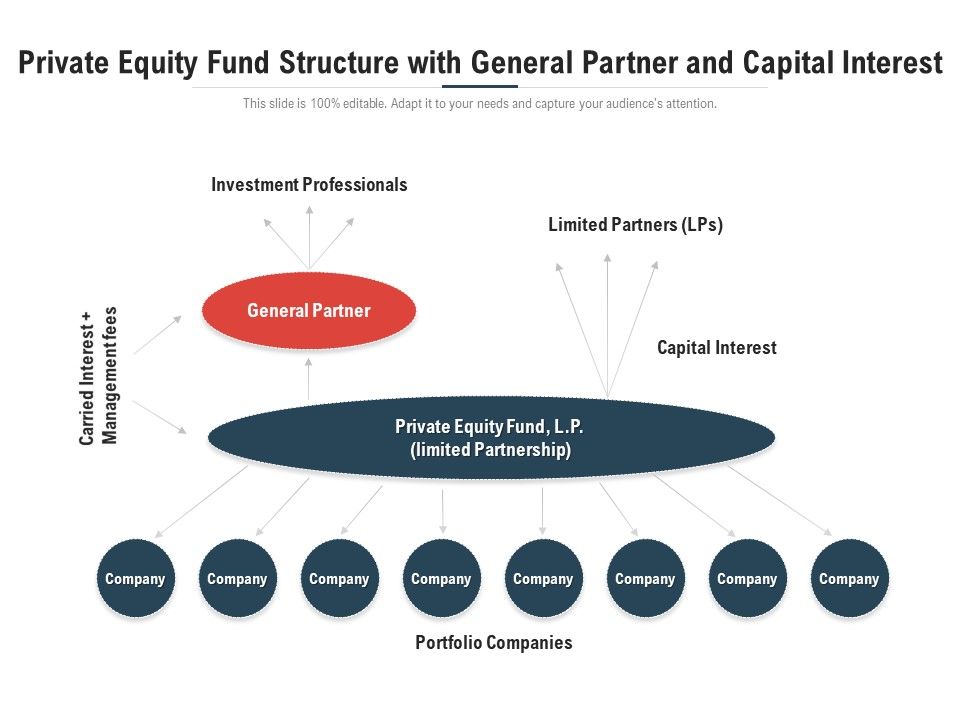

Private Equity and Hedge Fund Structure • Capital can be raised from both U.S. and overseas accredited individuals and/or institutional investors. Therefore, a typical fund may have a general partner as well as U.S. limited partners and non-U.S. limited partners.

32 Private Equity Fund Structure Diagram - Free Wiring Diagram Source. Taxation of private equity and hedge funds - Wikipedia. Fund Structure of Private Equity and Venture Capitalists - FinanciaL ...

3 A good description of real estate private equity fund structure can be found in Andrae Kuzmicki and Daniel Simunac, "Private Equity Real Estate Funds: An Institutional Perspective," Real Property Association of Canada, 2008.

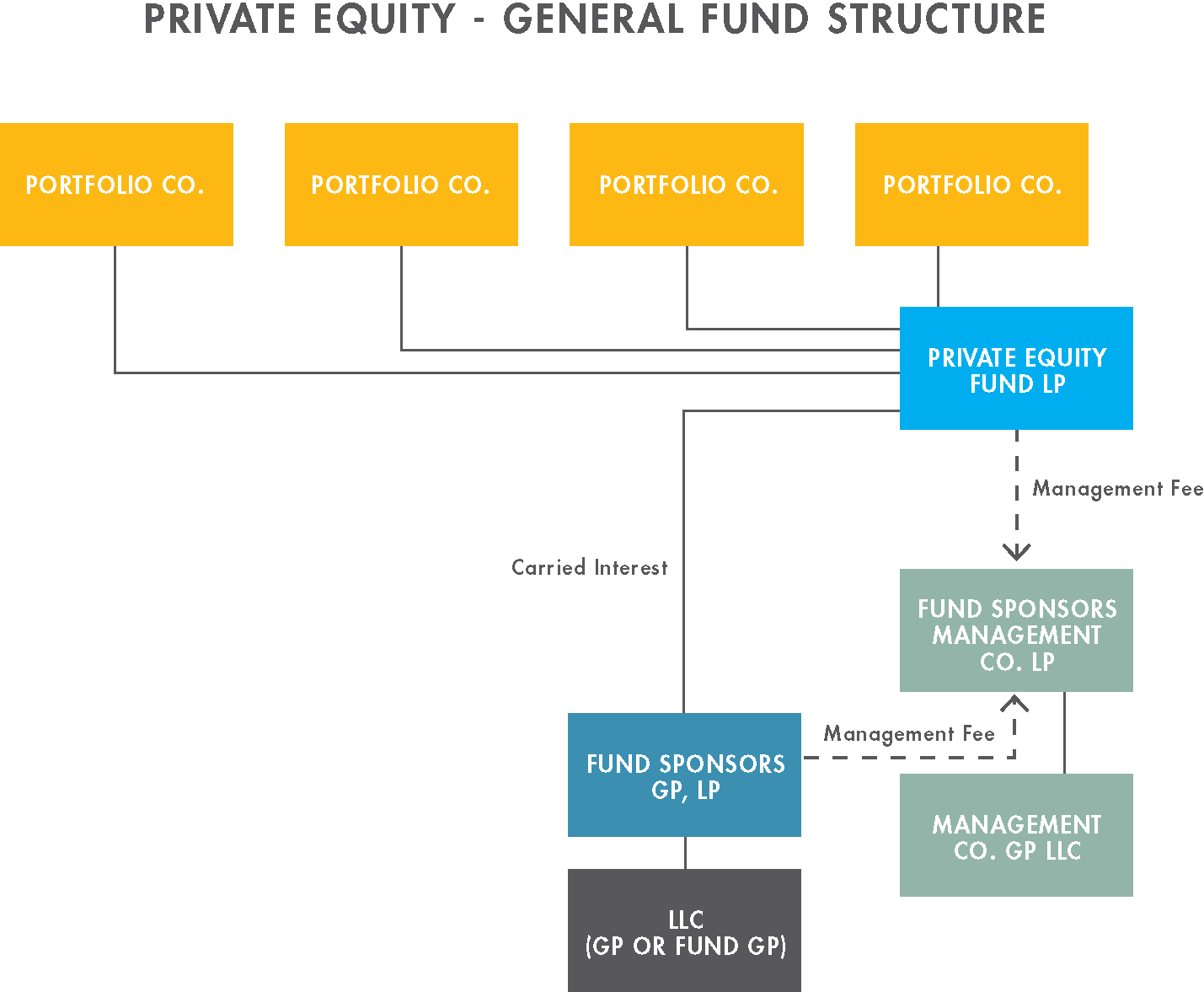

Most private equity funds are specifically designed to wind-down and terminate over a period of time. Advanced Limited Partnership Structure Funds pay a management fee and profit share (known as "carried interest" or "carry") to the GP for the management of the fund.

Private Investment Funds Practice attorney. About Morgan Lewis's Private Investment Funds Practice Morgan Lewis has one of the nation's largest private investment fund practices and is consistently ranked as the "#1Most Active Law Firm" globally based on the number of funds worked on for limited partners by Dow Jones Private Equity Analyst.

Private equity firms are structured as partnerships with one GP making the investments and several LPs investing capital. All institutional partners of the fund will agree on set terms laid out in a Limited Partnership Agreement (LPA). Some LPs may also ask for special terms outlined in a side letter.

Diagram of the structure of a generic private-equity fund Most private-equity funds are structured as limited partnerships and are governed by the terms set forth in the limited partnership agreement or LPA.

on the distinction between hedge funds and private equity funds, see Box, Distinguishing Hedge Funds From Private Equity Funds). GENERAL FUND STRUCTURE The structure of a private equity fund generally involves several key entities, as follows: "!The investment fund, which is a pure pool of capital with no direct operations.

Private Equity Fund structure - Trust A Private Equity that is structured as a Unit Trust is a type of collective investment governed by a trust deed. The investors are usually the main beneficiaries of the Trust. The Fund's Net Asset Value (NAV) divided by the number of units outstanding determines the price of each unit of the Trust.

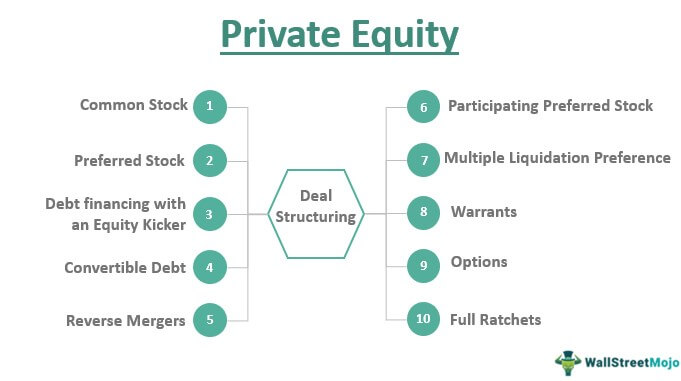

The goal of a private equity investment structure is to align the interests of the various parties who invest in an individual deal or a private equity fund. Private equity waterfalls can take different forms based on each party's goals as well as ensuring the other stakeholder has the correct incentives in the investment along with the other ...

Fund Structure found in: Investment Fund Structure Ppt PowerPoint Presentation Model Summary, Limited Partners Funds Structure Ppt PowerPoint Presentation Show Example, Sample Of Fund Structure Diagram Ppt Presentation, Private..

Although minimum investments vary for each fund, the structure of private equity funds historically follows a similar framework that includes classes of fund partners, management fees, investment ...

Diagram of the structure of a generic private-equity fund A private-equity firm is an investment management company that provides financial backing and makes investments in the private equity of startup or operating companies through a variety of loosely affiliated investment strategies including leveraged buyout , venture capital , and growth ...

Private Equity Fund structure - Master-Feeder Fund A Feeder Fund is an investment vehicle that consists in the pooling of capital commitments from investors. A Feeder Fund invests, or feeds this capital, into an umbrella fund, often called a Master Fund (Main), which directs and oversees all investments held in the Master portfolio. Private equity fund structure diagram.

advising private equity, growth equity, and venture capital funds and their portfolio companies in a wide variety of transactions including leveraged buyouts, recapitalizations, M&A, and growth-equity financings. A blocker corporation is sometimes used by a PE or VC fund to invest in an LLC or partnership. Goodwin Procter's John LeClaire and ...

Here is a Structure of a Private Equity Deal 'Sourcing' and 'Teasers' Signing a Non-Disclosure Agreement (NDA) Initial Due Diligence Investment Proposal The First Round Bid or Non-Binding Letter of Intent (LOI) Further Due Diligence Creating an Internal Operating Model Preliminary Investment Memorandum (PIM) Final Due Diligence

Many private equity fund agreements contain a provision permitting, or under certain circumstances ... fund, modified only to reflect the AIV structure itself and for changes necessitated by legal differences between the vehicles (e.g., Cayman Islands law will govern a Cayman Islands limited partnership).

A. Plain vanilla fund structure PlainVanillaFund Offshore Investment Investors Investment management Type9SFClicencerequired (iffundmanagement functioninHong Kong) 3 Offshore Fund (incorporated as a ... Advised a European fund manager on private equity investment in an offshore holding

As engineers of some of the earliest innovative instruments being used by investment funds (both private equity and venture capital) in India we proactively spend time in developing an advanced under-standing of the industry as well as the current legal, regulatory and tax regime. Choice of Fund Vehicle Structure follows strategy, and not vice ...

Please note: This is a simplified illustration and explanation of three structures that can be used for investment funds. These diagrams do not illustrate all of the entities involved in forming, operating, or managing a fund. This diagram does not provide a definitive illustration of any particular fund structure, any guidance on,

The type of private equity fund structure can impact how the accounting information for each investment and that of the company as a whole are recorded. The level of analysis the private equity ...

Download scientific diagram | 1-Private Equity Fund Structure from publication: The Patterns of Private Equity Investment in Ireland, 2007 - 2014 | Abstract Over the last decade developments of ...

0 Response to "35 private equity fund structure diagram"

Post a Comment