34 cash flow diagram calculator

This is a very useful cash flow Excel template which can be used to calculate the inflow and outflow of cash for a company to calculate its net cash balance. Creating a Cash Flow Statement: Creating a cash flow can be a tough job since there are two methods you can follow- the direct and the indirect methods. Estimate Your Cash Flow Forecasts. For a business to survive long-term, cash is the king of all performance indicators monitored. Many a profitable business has gone into liquidation because they have a negative bank balance and no more lending agreements available. Calculate a 12 monthly forecast for sales, start-up costs and regular monthly ...

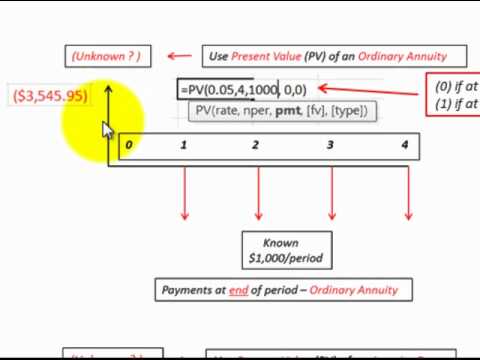

To calculate the present value of any cash flow, you need the formula below: Present value = Expected Cash Flow ÷ (1+Discount Rate)^Number of periods. Thus, for year one, the math would look like ...

Cash flow diagram calculator

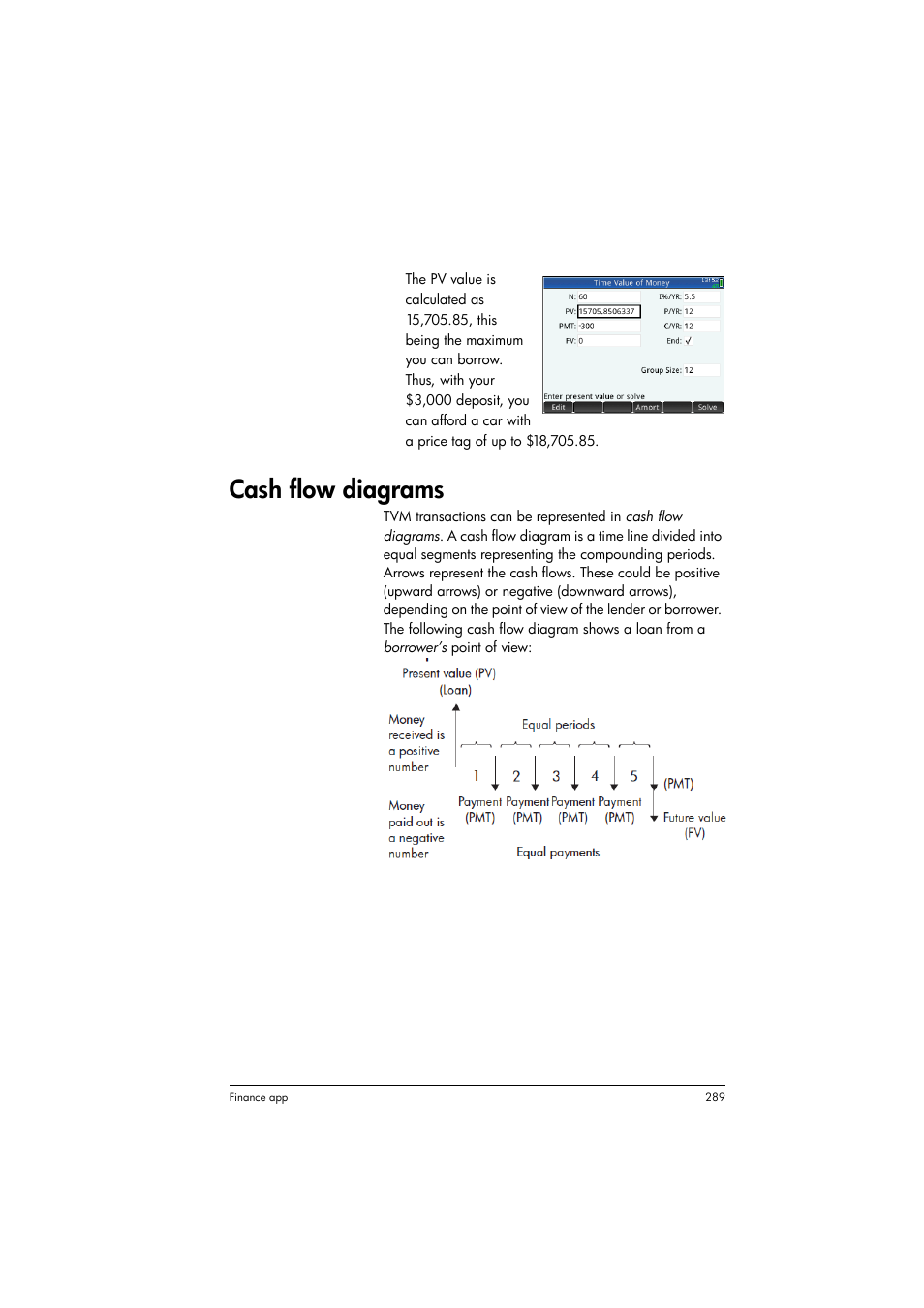

A calculator will give you a detailed report about the present value of your future cash flows. These cash flows can be fixed or changing. Factors that are important to achieve an accurate result on a calculator are: Interest rate or discount rate (per period) - While using iCalculators calculator, you have to enter the expected interest rate ... How to calculate your cash flow forecast: Your cash flow forecast is actually one of the easiest formulas to calculate. There aren't any complex financial terms involved—it's just a simple calculation of the cash you expect to bring in and spend over (typically) the next 30 or 90 days. In order to calculate NPV, we must discount each future cash flow in order to get the present value of each cash flow, and then we sum those present values ...

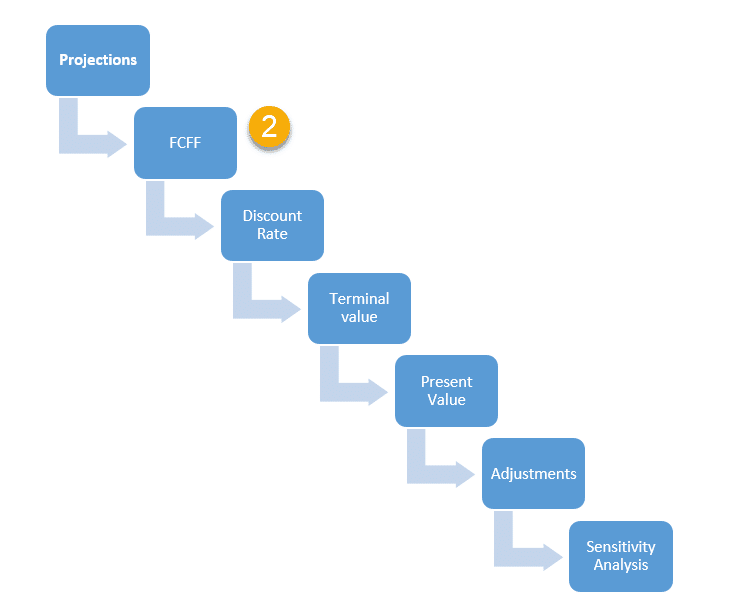

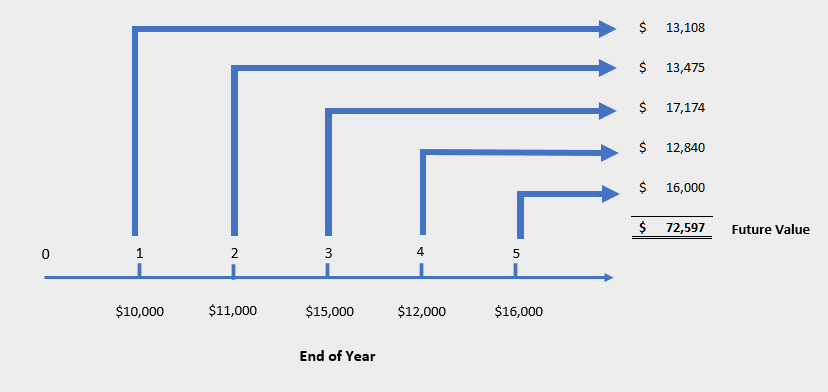

Cash flow diagram calculator. F V = P V ( 1 + i) n. Substituting cash flow for time period n ( CFn) for PV, interest rate for the same period (i n ), we calculate future value for the cash flow for that one period ( FVn ), F V n = C F n ( 1 + i n) n. If our total number of periods is N, the equation for the future value of the cash flow series is the summation of individual ... Therefore, (and as shown in the chart below) to calculate operating cash flow, you'd start with the net income from the bottom of your income statement. All non-cash items are added to your net income, such as depreciation, stock-based compensation, and deferred taxes. Once you have this number, you'd subtract changes in working capital. This video from CEE300 - Engineering Business Practices explains how to use a cash flow diagram (and a calculator) to compute the net present value of a busi... problems), cash flow diagrams can be drawn to help ... The cash flow diagram is shown in ... The interest rate that is used in calculations is known as.13 pages

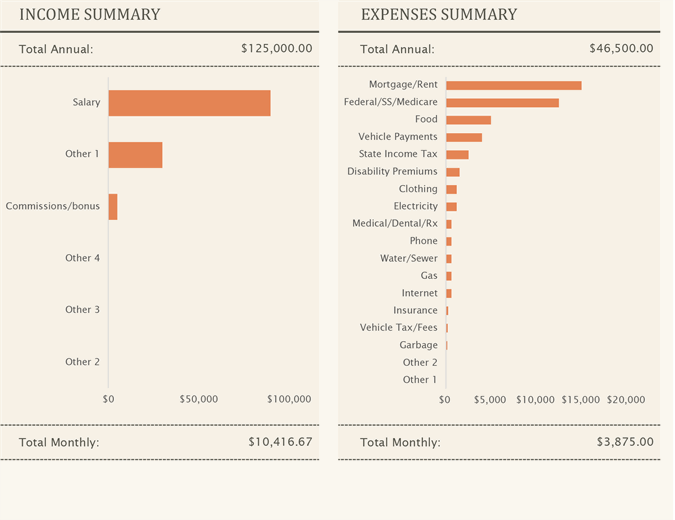

Discounted Cash Flow Calculator. Analysts use discounted cash flow to explore the time value of money. Essentially, money today is worth more than the same amount of money tomorrow. Explore this concept and the related idea of the net present value of investments in this useful business calculator. Enhancing the Cash Flow Diagram. Now that we know how to draw cash flows, we can embellish our diagram to make it more useful. In general we want to add labels to our diagram but only to the point that they are helpful. Keep in mind that the purpose of the diagram is to illustrate a complex financial transacation as concisely as possible. Go with the cash flow: Calculate NPV and IRR in Excel. Excel Details: Stop tossing and turning.Relax and go with the flow.Cash, that is.Take a look at your cash flow, or what goes into and what goes out of your business.Positive cash flow is the measure of cash coming in (sales, earned interest, stock issues, and so on), whereas negative cash flow is the measure of cash going out (purchases ... Personal Cash Flow Calculator. ... Net Cash Flow . Today's Boydton Savings Rates. The following table shows current rates for savings accounts, interst bearing checking accounts, CDs, and money market accounts. Use the filters at the top to set your initial deposit amount and your selected products. ... And once you take the time to chart your ...

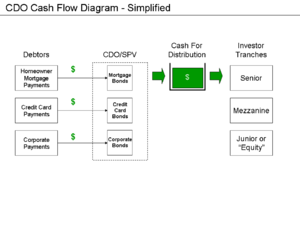

Once you are satisfied with your cash flow entries, click the "Calculate Net Present Value" button. This will display the present value of the discounted cash flows, along with a year-by-year chart showing the outflow, inflow, net cash flow, and discounted cash flow for each cash flow year. Back to Calculator. Cash Flow Diagram vs Cash Flow Table. Similar to cash flow tables, cash flow diagrams show the cash activities of a department or project. The difference is how they represent cash movements. Diagrams are typically easier to follow and understand. Let's look at a diagram of the cash flow table used earlier in the article: Cash Flow Templates This is our small assortment of professional cash flow spreadsheets. Created by professionals with years of experience in handling private and professional finances, these free excel templates have been downloaded times since 2006. We only have templates as of today. Cash flow planning and cash flow report are the templates you can download below, but we are working on ... Cash Flow Diagram Generator is a financial tool that helps in analyzing a company's cash flow. It is a tool that is very useful for companies, entrepreneurs and individuals who have a business or project to manage. In this Cash Flow Diagram Generator template, you will be able to see the movement of money in your business.

This flow rate calculator uses flow velocity and cross-sectional flow area data to determine the volumetric flow rate of liquid. You can calculate the flow rate in five simple steps: Select the shape of the cross-section of the channel. Input all the measurements required to compute the cross-sectional area. Input the average velocity of the flow.

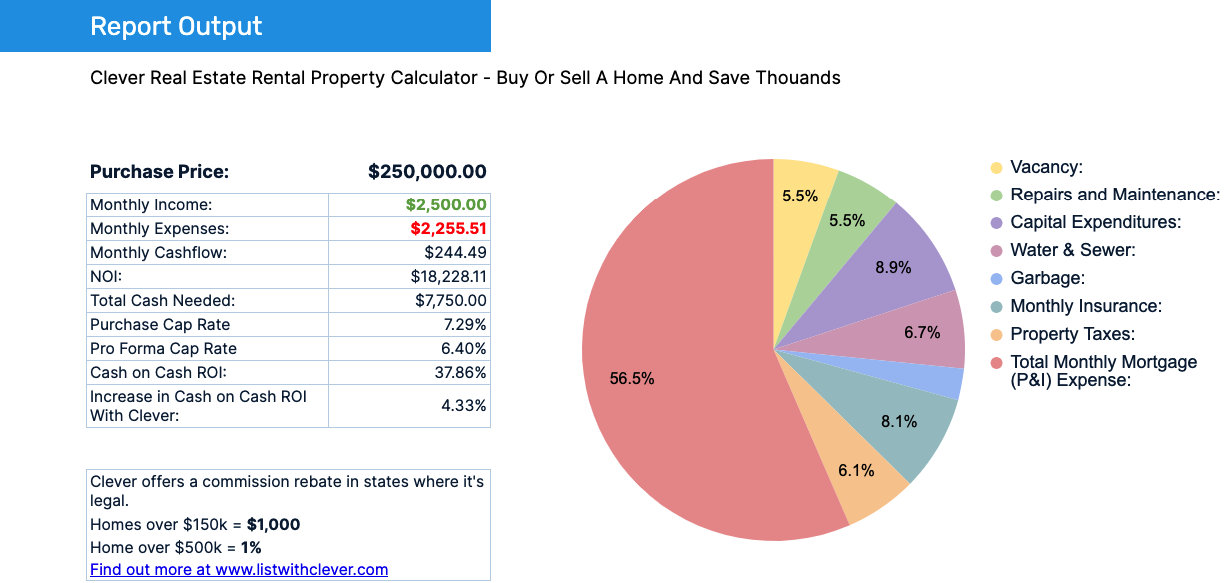

Rental Property Cash Flow Calculator. This calculator figures your real cash flow. It uses mortgage payments, taxes, insurance, property management, maintenance, and vacancy factors. Not only does it allow you to enter your maintenance and vacancies into the calculator, but it also gives you a table with suggested values based on the age and ...

Cash Flow Calculator. Having adequate cash flow is essential to keep your business running. If you run out of available cash, you run the risk of not being able to meet your current obligations such as your payroll, accounts payable and loan payments. Use this calculator to help you determine the cash flow generated by your business.

Cash flow calculators focus on core activities because, if they consume more cash than they provide, the business is very likely to be in real jeopardy. Operating Cash Flow Calculator Models The template provides two models, the Yearly and Monthly, and is built in Excel, so you probably already have everything you need to run it.

A cash flow statement, also referred to as a statement of cash flows, shows the flow of funds to and from a business, organization, or individual. It is often prepared using the indirect method of accounting to calculate net cash flows.

The items in the cash flow statement are not all actual cash flows, but "reasons why cash flow is different from profit." Depreciation expense Depreciation Expense When a long-term asset is purchased, it should be capitalized instead of being expensed in the accounting period it is purchased in. reduces profit but does not impact cash flow (it is a non-cash expense).

Uniform Series Sinking Fund, Capital Recovery. Uniform Series Compound Amount. Uniform Series Present Worth. Uniform Gradient Present Worth

Example Cash Flow Problem. Starting in year 3 you will receive 5 yearly payments on January 1 for $10,000. You want to know the present value of that cash flow if your alternative expected rate of return is 3.48% per year. You are getting 5 payments of $10,000 each per year at 3.48% and paid in advance since it is the beginning of each year.

A Residual Split is included to handle any remaining excess cash flows. After calculation, you can view a dynamic waterfall diagram, as well as return metrics for the project, investors, and the manager. A detailed distribution waterfall outlines the cash flows on a yearly basis and performs annual cash flow checks.

The HP 12c memory organization allows up to 20 different cash flow amounts plus the initial investment to be stored and handled according to the diagram in ...

Accounts Receivable Between Money From Sales And Cash Flow Diagram Accounting Concept Stock Vector Illustration Of Payment Finance 170882340

Cash Flow Diagrams. Cash flow diagrams visually represent income and expenses over some time interval. The diagram consists of a horizontal line with markers at a series of time intervals. At appropriate times, expenses and costs are shown. Note that it is customary to take cash flows during a year at the end of the year, or EOY (end-of-year).

Cash at end of period: Total cash calculated for the end of the period. If this amount is lower than your beginning balance, your business has a negative cash flow. If this amount is negative, you may need to increase your cash flow to maintain your current operations. Received from customers: Cash received from your customers for the period.

Stay informed about the latest investor initiatives, educational resources and investor warnings and alerts. Sign Up.

Calculate the net cash flow from operating activities. Add up the inflow, or money that came in, from daily operations and delivery of goods and services. Include income from collection of receivables from customers, and cash interest and dividends received. Next, calculate the outflow. Cash outflows from operations include cash payments for ...

The Present Value of the cash flows can be calculated by multiplying each cash flow with a Discount Rate. Present Value cash flow flow calculator; Cash Flow Diagram - Investment Transaction. An investment transaction starts with a negative cash flow when the investment is done - and continuous with positive cash flows when receiving the pay backs.

Free cash flow to equity - Also referred to as levered FCF. It's the amount of cash a business has after it has met its financial obligations. Examples of financial obligations covered by levered cash flow are operating expenses and interest payments. Analysts use variations of the FCF equation to calculate free cash flow to the firm or equity.

In order to calculate NPV, we must discount each future cash flow in order to get the present value of each cash flow, and then we sum those present values ...

How to calculate your cash flow forecast: Your cash flow forecast is actually one of the easiest formulas to calculate. There aren't any complex financial terms involved—it's just a simple calculation of the cash you expect to bring in and spend over (typically) the next 30 or 90 days.

1 The Traditional Tvm Calculation Is Appropriate When There Are A Periodic Cash Flows Of Varying Amounts Occurring At Irregular Intervals B Course Hero

A calculator will give you a detailed report about the present value of your future cash flows. These cash flows can be fixed or changing. Factors that are important to achieve an accurate result on a calculator are: Interest rate or discount rate (per period) - While using iCalculators calculator, you have to enter the expected interest rate ...

0 Response to "34 cash flow diagram calculator"

Post a Comment